Announcements

Drinks

European banks in Russia: exceptional factors drive profits amid pressure to exit

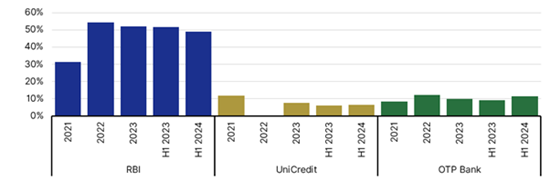

RBI retained the highest exposure of the three as of end-June 2024, with 17.2% of risk-weighted assets remaining in Russia, compared to 5.1% for UniCredit and 4.8% for OTP Bank. The combined net profits of the three banks in Russia grew by 9.1% in the first half of 2024 to EUR 1.2bn, although the ability to repatriate these earnings remains constrained.

Heightened reputational, legal and financial risks, including seizure of assets amid international sanctions, have prompted a cautious approach that will persist, particularly given the risk of fines or the termination of correspondent banking relationships as a result of potential sanctions investigations by European or US financial authorities.

However, in the event of disorderly exits, such as the deconsolidation of Russian subsidiaries and write-downs of intra-group exposures, the impacts on consolidated capital adequacy should be manageable for the groups.

Contribution of Russian subsidiaries to the groups’ consolidated net profit

Source: banks’ financial data, Scope Ratings

“The deconsolidation process of Russian subsidiaries is challenging, given local legislation and the need for multi-stage approvals. We believe recently announced reduction plans are constructive, although not entirely consistent with regulators’ calls for an accelerated exit from Russia,” said Milya Safiullina, an analyst in Scope’s financial institutions team. “We see an open dialogue with regulators and financial authorities as an important cornerstone of constructive decision-making for the banks, which are focused on an orderly exit from their Russian businesses.”

Profits are primarily driven by the spread between the interest rates paid to Russian depositors and the interest rates offered bythe Bank of Russia, the central bank. While European banks have limited new lending activities in recent quarters in an effort to shrink their presence in Russia, they have seen a very large influx of deposits, boosting their liquidity. A significant amount of excess liquidity of Russian subsidiaries is placed with the Bank of Russia.

“Making profits is possible without expanding the customer base or even shrinking it,” Safiullina said. “Another reason is the release of significant loan-loss provisions as asset-quality trends have been stronger than the banks had anticipated since February 2022 when international sanctions sharply escalated.”

The Russian subsidiaries of foreign banks are still connected to SWIFT, the global financial messaging system, so play a crucial role in the transfer of money in and out of Russia. Commissions paid for transactions coupled with high customer demand have enhanced profits since February 2022. Cross-border payments are declining, however, or even have stopped in US dollars at the major banks.

Since 2022, euro area banks have been under pressure to examine all options regarding the future of their Russian subsidiaries, including downsizing activities and exit strategies. The ECB recently requested that all banks speed up their measures. Yet only a few foreign banks have been able to sell their business in Russia, and even then, with big losses. Société Générale and HSBC sold their Russian units; Intesa Sanpaolo has secured approvals to dispose of its assets in the country but the deal has not yet completed.

Banks have taken significant measures to mitigate the risks of their presence in Russia, including from sanctions compliance. “We believe compliance frameworks are well established, although the potential investigations initiated by regulators and US financial authorities may carry risks of fines or the termination of business relationships with correspondent banks,” Safiullina said. At the same time, the risk of asset seizure in Russian units is increasing. Transactions that cannot be completed due to international sanctions put banks at greater risk of such rulings and weigh on provisions.

Download the full report here.

Stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.