Announcements

Drinks

Car finance exposures will have moderate impact on UK banks rated by Scope

By Alvaro Dominguez Alcalde, Financial Institutions

The Court of Appeal ruling that that car dealers offering customers finance have a duty to disclose any commission they receive from lenders, and holding lenders accountable for any non-disclosure by dealers sent shockwaves through the UK car finance market. The ruling sets a more stringent standard for disclosure and consent regarding discretionary commission arrangements (DCAs) than Financial Conduct Authority (FCA) guidance. The findings of the FCA’s own review of car finance practices, initiated in January, are expected in May 2025.

To date, Lloyds is the only bank in Scope's portfolio of UK-rated financial institutions to have made provisions in relation to this issue, recognising a GBP 450m provision for operational and legal costs and potential customer redress in its Q4 2023 results. On 28 October, the bank announced that it is “assessing the potential impact of the decisions as well as any broader implications, pending the outcome of the appeal applications as well as updating the market, if and as appropriate”.

Santander UK had stated in its Q2 2024 results that no provisions were required, but the court decision forced the bank to delay its Q3 2024 results to further assess the potential impact. While Santander UK has not provided any estimates, Santander’s group CFO José García Cantera noted in a recent interview that the financial impact on the group will not be material, with an estimated effect on net income significantly below EUR 600m.

Barclays exited the motor finance market in 2019 but in its Q3 2024 results noted an uptick in complaints and legal claims against its Clydesdale Financial Services (CFS) subsidiary and that it had begun a judicial review challenge against the Financial Ombudsman Service (FOS) in the High Court in relation to commission arrangements and disclosures in the sale of motor finance products.

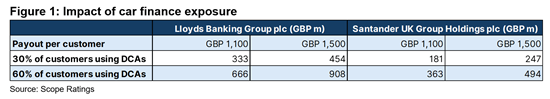

We analysed four scenarios to estimate the impact of potential customer compensation based on the size of the banks’ car finance books in 2020 (prior to the ban on DCAs in 2021), an average UK car price of £14,600 based on the Auto Trader Retail Price Index between February 2011 and December 2020, and compensation awarded in two mis-selling car finance cases brought by the Financial FOS against Black Horse Motor Finance and Barclays Partner Finance.

Our scenarios were:

30% of customers affected by DCAs and compensation of GBP 1,100 per customer.

30% of customers affected and compensation of GBP 1,500.

60% of customers affected and compensation of GBP 1,100.

60% of customers affected and compensation of GBP 1,500.

While a number of small banks and non-banks are involved in the UK motor finance sector, the large banks rated by Scope are well equipped to deal with potential fallout. UK banks in our rated universe with significant exposure to auto finance had an average RoTE of 12.2% in the first half of 2024, maintaining the positive performance seen in recent years.

Even under a stressed scenario in 2024, including no loan growth, deteriorating asset quality, and compensation for car finance mis-selling, Scope's rated banks would remain profitable. In a worst-case scenario Lloyds Banking Group plc would maintain profitability at over GBP 3.9bn with a return on average equity of around 10% while Santander UK Group Holdings plc would achieve around GBP 850m in profits with an ROE of around 6.5%.

Issuer rating reports available to ScopeOne subscribers:

Barclays Plc

HSBC Holdings Plc

Lloyds Banking Group Plc

NatWest Group Plc

Santander UK Plc

Stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.