Announcements

Drinks

Ukraine: geopolitical events likely to increase role of supranational institutions

By Eiko Sievert and Julian Zimmermann, Sovereign and Public Sector

Support for Ukraine (SD) has been channelled bilaterally from individual countries, while supranationals such as the EU, EBRD and EIB (all rated AAA/Stable) have provided funding for reconstruction, recovery and basic needs, amounting to around 22% of the total.

Supranationals continue to provide financing to support Ukraine’s economic and social development and will play a crucial role in the country’s eventual reconstruction phase once the war ends.

EU

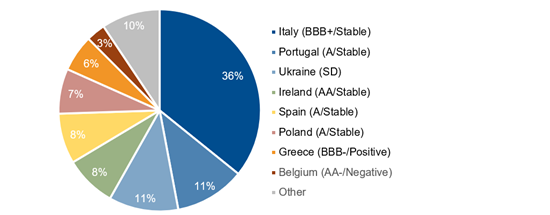

The EU has allocated significant funding support for Ukraine since Russia’s escalation of the war. Direct exposures at the end of 2023 amounted to EUR 29.6bn, including (i) EUR 4.7bn in legacy Macro-Financial Assistance (MFA) and Euratom loans, (ii) EUR 1.2bn emergency MFA loans, (iii) EUR 6bn exceptional MFA loans, and (iv) EUR 18bn of MFA+ loans. Total outstanding exposure to Ukraine at end-2023 amounted to around 11% of EU loans. Despite the large upcoming payouts related to member states’ recovery and resilience facilities under NextGenerationEU, the share of borrowings related to Ukraine is likely to increase over coming years and could reach around 15-20% based on support measures agreed to date.

Throughout 2024 further financial support measures were announced, including the launch of the Ukraine Facility in February 2024 with an overall capacity of EUR 50bn in the period 2024-2027, of which EUR 33bn will be distributed as loans and EUR 17bn as grants.

In October 2024, the European Council also adopted a financial assistance package, including an exceptional MFA loan of up to EUR 35bn and a loan cooperation mechanism that will support Ukraine in repaying loans for up to EUR 45bn provided by the EU and G7 partners. The loans will be repaid by profits from immobilised Russian sovereign assets.

Figure 1: European Union country exposure, loans (%)

Source: European Commission, Scope Ratings

EBRD

The EBRD, whose largest shareholder is the United States with 10% of subscribed capital, ahead of France, Germany, Italy, Japan and the UK with 8.6% each, suspended new lending to Russia at the time of the invasion of Crimea in 2014, and to Belarus with escalation of Russia’s war in Ukraine.

At the same time, the bank has significantly increased its activities in Ukraine, with new investments of just over EUR 3bn in 2022-23, of which on average 50% benefit from guarantees from shareholders. The bank aims at around EUR 1.5bn in investment commitments per annum during wartime.

To support this level of funding, the EBRD’s capital base will be supported in coming years by an increase of EUR 4bn in paid-in capital. The increase will be effective from 31 December 2024, raising the bank’s subscribed capital to around EUR 34bn, with paid-in capital at around EUR 10bn.

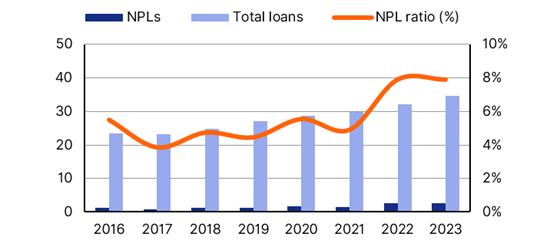

The exposure in Ukraine also resulted in higher non-performing loans (NPLs), standing at 7.9% of total loans at end-2023, up from 4.9% at end-2021. Around half of loans in Ukraine were classified as non-performing as of H1 2024. Associated risks to the bank are well covered thanks to appropriate provisioning, post-model adjustments and donor guarantees.

Figure 2: EBRD: war in Ukraine drives non-performing loans

Source: EBRD, Scope Ratings

EIB

Since early 2022, the EIB has disbursed more than EUR 2bn in emergency relief and project support to Ukraine. In March 2023, the EIB announced the EU for Ukraine Fund, demonstrating the bank’s commitment to assist Ukraine and support its long-term goal of acceding to the EU. At end-2023, the disbursed lending exposure to Ukraine, including guarantees, was about EUR 3.1bn. This exposure is almost entirely covered by EU guarantees, mostly under the external lending mandate.

As a main implementing partner of the EU’s Ukraine Facility, the EIB will help with the deployment of more than EUR 2bn. The EIB will therefore continue to play a crucial role in disbursing funds in Ukraine, especially during the country’s reconstruction phase with investments in infrastructure, SMEs and larger businesses.

Download Scope's Supranationals Outlook 2025