Announcements

Drinks

Portugal: persistent political fragmentation to test growth and fiscal prospects

By Alvise Lennkh-Yunus and Alessandra Poli, Sovereign and Public Sector Ratings

The election in Portugal (A/Stable) confirmed the centre-right Democratic Alliance (AD) as the country’s leading political force but, with just 32% of the national vote and 89 out of 230 seats in parliament, it again lacks an absolute majority to govern.

With the Socialist Party losing political ground largely to the far-right party ‘Chega’, two parties with whom the AD has ruled out holding coalition talks, the AD will need the support from either of these two parties (at the minimum their abstention) to pass next year’s budget law.

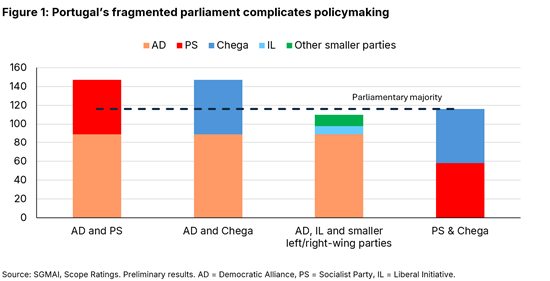

Even if AD were to gain the support from all other smaller parties, such an arrangement would still fall short of a majority should both Chega and the Socialist Party vote against it (Figure 1).

While Portugal has a history of minority governments and a confidence vote is not needed for forming a government, passing the annual budget law will be the first critical test for Portugal’s next administration.

Failure to pass a budget, thereby activating a temporary budget rule, would have import political repercussions, from the possible resignation of the prime minister to intervention by the president in dissolving parliament and calling new elections. Even if a budget is passed, a minority government would need ad hoc support from other parties to pass new legislation.

The efficient deployment of EUR 22.2bn Recovery and Resilient Funds (around 8% of GDP) is critical to sustain Portugal’s favourable growth outlook as is addressing economic and social issues such as affordable housing, better quality healthcare and improved immigrant welfare.

Portugal’s debt-to-GDP ratio remains on a firm downward trajectory

To be sure, the volatility in Portuguese politics contrasts with the country’s strong economic growth and significantly improving public finances.

The Portuguese economy has proved resilient in recent years, despite higher inflation and interest rates weighing on private consumption and investments. Real GDP grew by 2.6% in 2023 and 1.9% in 2024, well above the euro area average of 0.4% in 2023 and 0.8% in 2024.

This outperformance also reflects the increasing economic and export diversification, as well as success in attracting foreign direct investment, particularly in high value-added sectors such as IT, business and professional services.

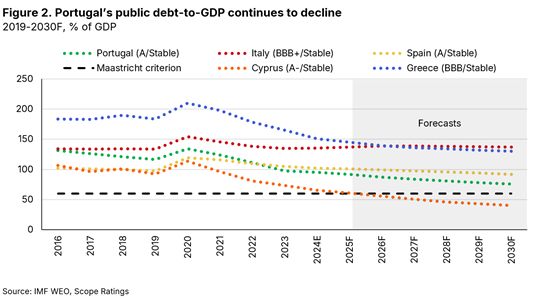

Buoyant economic growth together with a constantly high GDP deflator and prudent fiscal policy drove the decline in Portugal’s debt-to-GDP ratio by around 39pp to 94.9% in 2024 from 134.1% in 2020. The government has run a primary surplus of 2.5% of GDP in 2024, 3.1% in 2023, and 1.5% in 2022.

We expect Portugal’s debt-to-GDP ratio to continue to decline, falling by an additional 16pp to around 75% by 2030, a trend which compares favourably with southern euro area peers (Figure 2).

In the context of higher financing rates, declining debt-to-GDP will help contain the rise in interest expenses, which will likely remain stable at around 4% of revenue in the medium term. The relatively long average weighted maturity of government debt at 7.7 years is another mitigating factor.

Fiscal discipline improves primary balance, creates flexibility to address social pressures

The fiscal discipline demonstrated in recent years enabled Portuguese governments to accumulate budgetary headroom, creating some flexibility to gradually implement growth-enhancing measures. The previous AD-led government took some initiatives aimed at increasing salaries for public sector employees and other selected professional categories. It also introduced a 1.25% permanent increase for the lowest pensions, raised social benefits and extended fiscal benefits for young people, but also reduced the corporate income tax rate to foster business competitiveness.

A new AD-led minority government will likely continue to balance fiscal prudence with pro-growth measures to guarantee compliance with new EU fiscal rules. To secure support from main opposition parties, the AD will likely have to consider some mix of tax cuts for lower-income households, tighter immigration policy – at the centre of Chega’s political agenda – and the reversal of corporate tax cuts or the revision of tax benefits for young workers, advocated by the Socialist Party.

While compromises are needed and will likely loosen the fiscal stance somewhat, we still expect the government to continue to run primary surpluses in the coming years, at about 1.6% of GDP by 2030.

External and domestic political uncertainties pose risks for the future

Gradually easing financing conditions and lower inflationary pressures, coupled with the expected acceleration in the implementation of the National Recovery Plan, should support real economic growth in the coming years, which we project at 2.1% this year and 1.9% in 2026, in line with the economy’s medium-run growth potential.

Key risks include the domestic political stalemate delaying reform and hindering the deployment of EU funds but also the volatile global trade environment. While the direct impact of higher tariffs applied by the US on imports globally is limited for Portugal, as good exports to the US account for less than 7% of total good exports, the country is vulnerable to the indirect impact of higher tariffs, and the related uncertainty, on slowing economic growth among Portugal’s main trading partners.