Announcements

Drinks

Portugal’s favourable debt dynamics set to continue despite modest fiscal loosening

By Carlo Capuano and Alessandra Poli, Sovereign & Public Sector

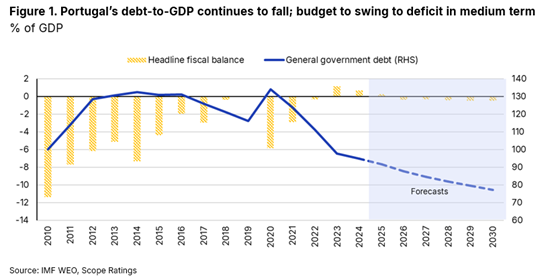

The two fiscal stimulus measures announced earlier this month by Portugal’s (A/Stable) minority government support our view that Portugal’s fiscal headroom is gradually declining despite favourable debt dynamics. The headline budget surplus will narrow to around 0.3% of GDP in 2025, down from the peak of 1.2% of GDP in 2023 and 0.7% in 2024, before turning into a small deficit of 0.3% in 2026.

As the economy continues to grow close to potential, the expected impact on GDP from the adopted measures will likely be modest in the near term. However, the favourable economic outlook, with growth of 1.9% on average in 2025-26, coupled with a sound primary balance, should ensure that public debt-to-GDP remains on a firm downward path.

The debt-to-GDP ratio should continue to fall to around 77% of GDP by 2030 from around 95% in 2024, with primary surpluses expected to gradually decline below 1.5% of GDP by 2028, down from 2.2% projected this year (Figure 1).

Fiscal loosening should not put fiscal surplus at risk as 2025 budgetary execution is sound

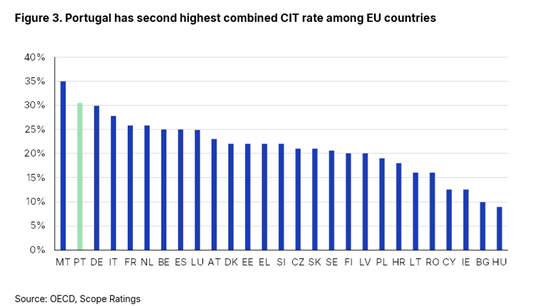

The current government has signed off an extraordinary pension supplement amounting to around EUR 400m for 2025, alongside continuation in the reduction of the corporate income tax (CIT) rate to 17% from 20% starting from 2026 until 2028. The latter is estimated lower fiscal revenues by around EUR 300-330m (0.1% of GDP), but aims to improve the country’s competitiveness, attract firms and boost FDI. The new measures follow additional spending on personnel, higher social benefits and lower taxes legislated previously.

The government also approved a further reduction in the CIT rate for SMEs to 15% from 16% for the first EUR 50k of income. Both measures are expected to be passed by parliament later this year thanks to the likely external support of the right-wing party Chega, which has advocated for a reduction in the CIT rate in the past.

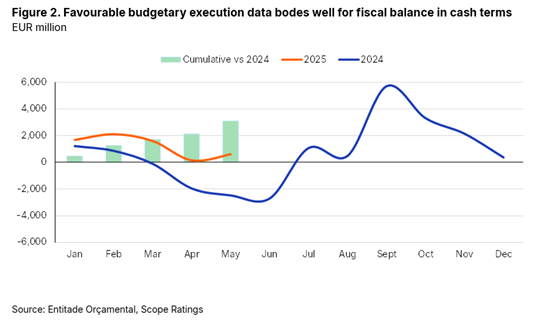

Though fiscal policy is now slightly more loose, expenditure otherwise remains under control and tax collection robust. The budget balance of the public administration recorded a surplus of EUR 597m in May (cash terms), representing an improvement of about EUR 3.1bn in the first five months of this year, compared with the same period in 2024 (Figure 2).

Fiscal revenues were particularly strong, increasing 12.3% while expenditure rose by only 4.5%, driven by personnel costs while financing costs were lower compared with 2024.

Our expectation for a balanced budget this year contrasts, however, with the Bank of Portugal’s (BoP) more conservative latest projections in June. The BoP, which does not incorporate the latest fiscal measures, factors in lower economic growth and a higher impact on public finances from the loan component of the Recovery and Resilience Plan. As a result, the BoP forecasts a fiscal deficit of 0.1% of GDP in 2025, which is set to widen to 1.3% in 2026.

Our expectation for a balanced budget this year contrasts, however, with the Bank of Portugal’s (BoP) more conservative latest projections in June. The BoP, which does not incorporate the latest fiscal measures, factors in lower economic growth and a higher impact on public finances from the loan component of the Recovery and Resilience Plan. As a result, the BoP forecasts a fiscal deficit of 0.1% of GDP in 2025, which is set to widen to 1.3% in 2026.

Economic impact of pension bonus limited; corporate tax cuts beneficial medium term

Almost 90% of Portugal’s pensioners, around 2 million people (or 20% of the population), will benefit from higher pensions in September this year. Though nominal disposable income will increase, the impact on economic activity will likely be modest, given the limited marginal propensity to consume of the elderly. Nevertheless, if this measure remains a one-off, it will not weigh structurally on public finances.

More potentially significant are the tax cuts considering Portugal has one of the highest CIT rates in the European Union. When state and municipal taxes are added, the country’s combined CIT rate exceeds 30%, the second highest in the EU, according to the OECD (Figure 3). This constrains investment and productivity. However, the lower rates will start delivering tangible economic benefits only in the medium term.

The latest tax reductions will likely stimulate the economy in the coming years, but any further fiscally expansionary policies would call for prudence to keep Portugal’s debt-to-GDP ratio on a firm downward trajectory. This is also due to the persistent the uncertainty over US trade policy (despite the recently announced EU-US trade deal) and domestic politics reflecting the fragmented parliament. Additional fiscal stimulus coupled with rising military expenditure and a moderate growth outlook could constrain further reductions in debt-to-GDP.

Scope’s next calendar review date for Portugal is on 31 October 2025.