Announcements

Drinks

Santander’s TSB acquisition strengthens UK focus, Sabadell re-focuses on domestic market

For Santander, the transaction confirms the UK’s relevance as a core market

The transaction will strengthen Santander’s (AA-/Stable) market position in the highly profitable but competitive UK market. Santander UK’s organic growth and profitability have been slower compared to other group’s core markets. The acquisition is small relative to the size of the group, while material for Santander UK as it will increase by 20% the size of its balance sheet, to a pro-forma total assets of GBP 300bn.

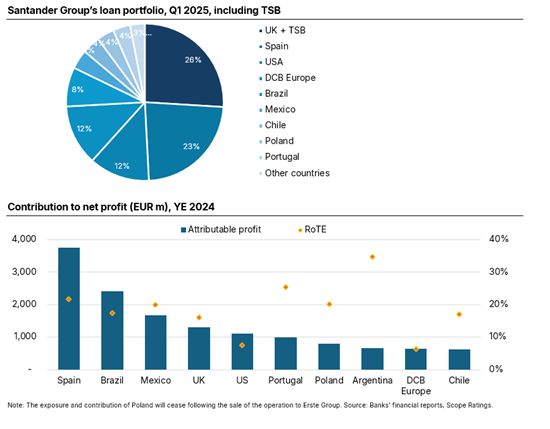

Further, the acquisition will increase the UK share in Santander’s global loan book to around 25%, surpassing Spain (23% as of Q1 25). It also allows the group to reduce its exposure to the more volatile operations in emerging markets, as mature markets will now make up more than half of the group’s net profits.

Strong potential to improve Santander’s UK business

The transaction is in line with Santander’s strategy to strengthen its geographic diversification in core profitable markets. With its proven track record, Santander aims to raise its return on equity in its UK operation in 2028 to 16% from 10%-12%. Santander’ expects to realise at least GBP 400m, equivalent to 13% of its combined cost base. TSB has been improving its efficiency (72%cost-to-income as of Q1 25) but still remains weaker compared to Santander’s UK’s 54%.

Santander group’s CET 1 ratio will not be materially impacted by the acquisition (12.9% in Q1 25), remaining at the upper range of the 12-13% guidance for 2025. The acquisition also confirms the group’s optimisation strategy of re-investing excess capital to expand businesses that generate profitability above the cost of capital.

While the acquisition will have a 50bp negative impact on CET1 capital at closing, this will be absorbed by the positive impact of above 100bp from the sale of 49% of its Polish operation to Erste Group, to be concluded later this year. A gain on capital could come from an increase in the organic capital generation from the stronger performance of the UK business, with an expected 20% return on invested capital.

Sabadell becomes a Spanish pure play as geographic diversification ends

In contrast, Sabadell’s sale of TSB will slim down its business to an exclusive domestic focus. The timing to exit the UK market is questionable as TSB had recently stabilized its performance, generating a bottom line of EUR 253m in 2024 (up from EUR 195m in 2023), representing 14% of Sabadell group’s profits. By eliminating its overseas operations, the sale will put pressure on Sabadell to accelerate growth in Spain in coming years.

The strength of the domestic franchise is core to Sabadell’s’ credit profile. The Spanish banking sector is performing well, outpacing growth in other EU countries and supported by dynamic domestic demand and resilient employment levels. However, because the UK and Spain present a different set of macroeconomic and bank performance drivers, TSB did provide an opportunity to mitigate the effects of a potential slowdown in the Spanish economy and consequently its effects on the group’s overall performance.

The financial impact of the TSB sale on Sabadell is neutral. The sale will result in stronger performance metrics, as TSB had been lagging the Spanish operations in efficiency, asset quality and profitability. Further improvements now fully hinge on Sabadell’s ability to grow its domestic operations organically.

Proceeds from the sale will almost entirely be paid out via an extraordinary cash dividend. The transaction will also be neutral for Sabadell’s capitalisation. It will not add to the group’s resources to support accelerated growth or future M&A transactions, which in our view, limits any upside for relevant scalability in the medium term.

Implications for the still ongoing tender offer from BBVA

The sale of TSB adds further complexity to the valuation of Sabadell in the context of BBVA’s bid, following the Spanish government’s approval with conditions that prevent BBVA from pursuing its initial plan to merge with Sabadell. BBVA will now need to re-assess the fair value of the offer and adjust it to the revised business perimeter limited exclusively to Spain, reviewing the initial assumptions on potential synergies and value creation within this narrower scope.

Sabadell shareholders will now decide between a higher one-off remuneration, resulting from the sale of TSB and the expectations of growth focused only on the Spanish market, and the potential for higher value creation in the long-term from a revised BBVA offer.

See also:

- Updated rating report on Banco Santander S.A.

- Scope has a subscription rating on Banco de Sabadell SA. View the ratings and rating reports on ScopeOne, Scope’s digital marketplace.

- Spanish bank quarterly: trade doubts weigh on asset quality; fees and commissions key to profits

- UK banks quarterly: credit fundamentals still resilient but moderating