Announcements

Drinks

Mid-year European bank outlook: earnings expected to stay resilient through risks skewed to downside

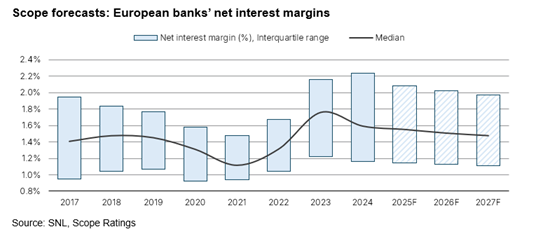

A pick-up in loan growth on the back of lower borrowing costs and more robust mortgage demand as housing market conditions improve will offer some tailwinds and mitigate the impact of shrinking margins to some extent.

“Bank M&A activity will continue to be buoyant. We expect more transactions in coming months as banks seek out new sources of value creation in a less favourable monetary cycle and move to consolidate their market positions, increase market share or enter new markets,” said Marco Troiano, Head of Financial Institutions. “Domestic deals continue to offer greater potential for value creation through cost synergies in physical distribution and overlapping central functions.”

Asset quality is solid, notwithstanding pockets of risk remain. “We expect some mild deterioration, particularly as the impacts of US tariffs play out amid potentially significant disruption in supply chains and resultant market volatility,” said Alessandro Boratti, Associate Director. Uncertainty will ultimately lower economic growth which will, in turn, negatively affect asset quality. That said, the aggregate NPL ratio is well below 3% in all the main EU countries. “We continue to rule out widespread defaults, particularly as lower interest rastes have softened the burden of debt service for borrowers,” Troiano added.

When it comes to banks’ efficiency metrics, cost/income ratios have risen, albeit from historical lows. Scope expects that the ratio will stabilise at around 52% in 2025, before rising to 54% in 2026. Pressure on core costs will moderate as wage pressures will to some extent be offset by redundancies and digitalisation. We expect 1% median growth in costs for 2025 and 2026. Banks with diversified business models i.e. including wealth management and insurance will outperform.

“We expect cost of risk to remain under control though we have lowered our outlook for this year and 2026 owing to the more concrete risk of a global trade war,” Boratti said. “That said, we expect most banks to comfortably absorb credit losses out of pre-provision profitability this year.” Most banks have unused management overlays that can be used if there is an uptick in defaults.

Banks maintain adequate buffers to regulatory capital, though buffers fell to a four-year low in Q1 2025, mainly due to rising shareholder distributions and the impacts of Basel III finalisation. However, strong profitability and RWA optimisation, partly using significant risk transfer, support capital creation.