Announcements

Drinks

EU-US trade deal: impacts on Italian banking sector will be manageable

We expect the EU-US trade agreement to have limited impact on Italian banks’ credit profiles, although it may have significant repercussions for some sectors of the Italian economy.

Exports to the US totalled EUR 64.7bn in 2024, according to Italy’s Ministry of Foreign Affairs, accounting for around 3% of Italian GDP. More than two thirds comprised machinery (20%), pharmaceuticals (16%), food and beverages (12%), transportation (including automotive, 12%), chemicals and electronics (4% each). Pharmaceuticals have been excluded from the trade deal for the time being, which implies that a higher levy could be applied, as hinted by US President Donald Trump.

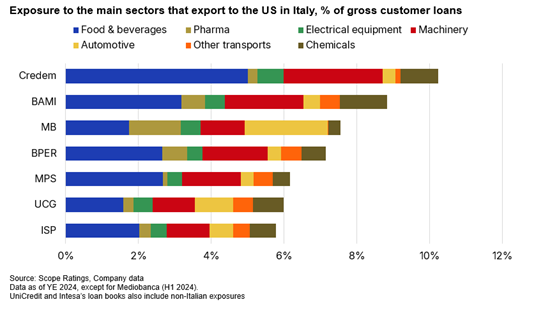

The exposure of large Italian banks to the sectors most vulnerable to US levies is limited. This reflects the degree of sector diversification in their corporate loan books. In fact, loans to these industries only account for between 6% and 10% of gross customer loans for the seven banks in our sample (Intesa Sanpaolo, UniCredit, Banco BPM, Banca Monte dei Paschi di Siena, Mediobanca, BPER Banca, Credito Emiliano). It is unrealistic to assume that these loans are entirely granted to exporters directly affected by the new US tariffs, so risks are contained.

Second-round effects warrant close attention

But tariffs could induce an economic slowdown, and this could lead to a broader deterioration in credit quality across various segments of the economy. Scope estimates that Italy could face a short-term output loss of 0.4pps, adding pressure to already modest growth.

Beyond asset-quality concerns, the main downside for Italian banks lies in the potential impact on revenue generation. Challenges to Italian economic growth could reduce already weak demand for loans, which would negatively affect banks’ net interest income. Loan growth in Italy is one of the lowest in the euro area, according to ECB data. As of May 2025, year-on-year growth in loans to households and companies in Italy was almost zero, compared to an average of around 2% across the euro area.

A weaker economic outlook in Italy and Europe coupled with lower inflation, as countries such as China target the EU to offset losses in trade with the US, could prompt the ECB to cut rates by more than expected. We currently forecast that the ECB deposit rate will reach 1.75% by the end of 2026 from 2% now. A scenario in which the ECB cuts rates by more or more quickly than our central assumption could erode banks' margins and reverse some of the recent profitability gains that Italian banks have enjoyed from widening interest margins.

We believe the new trade agreement will reduce uncertainty, but the lack of visibility around US trade policy could trigger market volatility. This would have mixed effects on the Italian banking sector. It would provide a revenue boost to institutions that have large capital markets operations (e.g. UniCredit), but it would have a negative impact on the sale of asset and wealth management products so would reduce performance-related fees. By way of example, there was a net outflow of assets under management of EUR 2.4bn in May 2025, according to Assogestioni, which at the time brought to an end to nine months of growth.

Italian banks well placed to face challenges

Italian banks are well placed to face these challenges, however. From a credit-risk perspective, their balance sheets are the strongest they have been since the Global Financial Crisis, supported by years of de-risking and better credit risk management. As of March 2025, the sector’s gross non-performing loan ratio stood at 2.8%, down from 17.1%. Since the pandemic, banks have accumulated large unassigned loan-loss provisions, most of which are still intact and provide a cushion against an unexpected deterioration in loan quality. UniCredit (A/Stable), Intesa (A/Stable) and Banco BPM hold overlays equivalent to approximately 40bp, 20bp and 15bp of customer loans, respectively.

Perhaps more importantly, Italian bank profitability has more than doubled over the past three years. Returns on risk-weighted assets for our seven sample banks averaged 3.1% in 2024, up from 1.2% in 2021, so although risks are skewed to the downside, the strong starting point means that Italian banks can withstand some pressure on revenues before materially impairing their ability to absorb credit losses through ordinary operating profitability. In 2024, average pre-provisions profits in our bank sample were 13 times larger than loan-loss provisions, which is a key credit consideration in our ratings.

See also:

EU’s sluggish economy faces moderate growth slowdown from US trade tensions

Mid-year European bank outlook: earnings expected to stay resilient through risks skewed to downside

Scope affirms Intesa’s A issuer rating with Stable Outlook

Italian Bank Quarterly: banks well positioned to weather economic headwinds