Announcements

Drinks

Covered Bond Quarterly: record issuance amid Russia’s invasion of Ukraine

“Russia’s invasion of Ukraine does not alter our general expectation for the market in 2022,” said Karlo Fuchs, Scope’s head of covered bonds. “Instead, the war is acting as an accelerator for already existing themes: surging inflation, a normalisation of monetary policy and the increasing sovereign debt pile.”

“As the ECB is slowly but steadily pulling back from the market, positive yields are once again attracting real-money investors. Credit factors, in particular the credit quality of banks and cover assets, will become a more relevant factor in the remaining year,” Fuchs added.

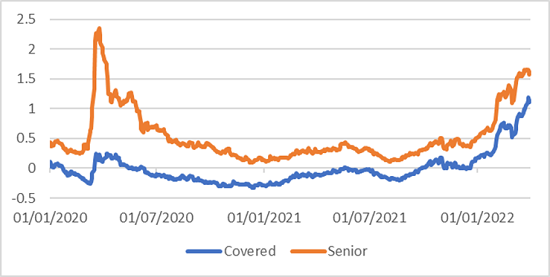

Yield developments

Source: Refinitiv, Scope Ratings

So far, the war has not harmed the credit quality of covered bonds. European banks entered this latest crisis from a position of strength, and direct exposures to Russia and Ukraine are not eligible under European covered legislation. There might be a small share of export loans in public-sector cover pools, but because these benefit from ECA guarantees, non-performance has no impact on cover pools other than a potential timing delay or lower over-collateralisation. Second-round effects, however, will result in lower economic growth and a faster increase in interest rates, ultimately hitting cover pools.

“When it comes to house prices, the rally continues, but recent increases in mortgage rates are making home purchases a luxury,” said Mathias Pleissner, deputy head of covered bonds. “Declining affordability among European households will likely halt the rally for the time being. The mix of rising inflation and the impact of the war prompted higher European mortgage rates in March and April, mainly in fixed-rate markets.”

The rate on a 10-year mortgage in Germany has more than doubled to above 2.5%, a level not seen since 2014. Pleissner believes this will likely reach over 3% within weeks.

“Regulators have identified the risks in the residential mortgage market and have increasingly used macroprudential measures to safeguard financial stability,” said Reber Acar, associate director. “Remaining white spots are now also being filled.” For example, Austria, which experienced one of the strongest house prices rallies among European peers, will activate lending restrictions from 1 July 2022.

On the harmonisation front, the 8 July deadline is now within reach. By then, harmonised covered bonds rules need to be transposed into national law. The good news: most legislators have already transposed the new rules, while the remainder are also close to the finish line. The bad news: there is still some way to go. As always, the devil is in the detail.

“Once regulations start being implemented, questions will arise from issuers and market participants. Secondary legislation and guidelines will then be needed to address those points. Examples include extendable maturities in Germany and Austria, and minimum over-collateralisation,” Acar concluded.