Announcements

Drinks

Spanish banks: solid Q2 performance; tax would erode repricing benefits

“All the Spanish banks in our sample would be subject to the banking tax under discussion in the Spanish Parliament,” said Chiara Romano, associate director in Scope’s financial institutions team. “If implemented as currently envisioned, as a temporary 4.8% tax levied in 2022 and 2023 on 2021 domestic net interest and commission income, it would considerably erode the 2023 benefits from rates increases,” Romano cautioned.

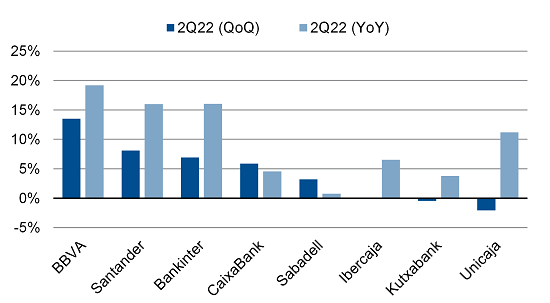

Rising fee and commission revenue reinforced the positive Q2 trajectory. Lower non-banking commissions were more than offset by growth in banking and insurance related commissions.

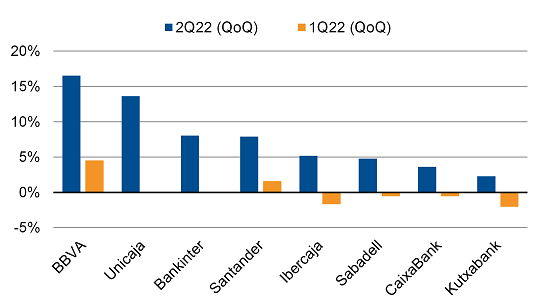

Net interest income growth

Source: Company data, Scope Ratings

Net F&C growth

Source: Company data, Scope Ratings

“Operating expenses are trending up for more geographically diversified lenders, although below composite inflation and – crucially – below revenues, leading to flat to marginally improving operating leverage,” Romano said For most domestic lenders, though, OpEx was flat-to-declining both in the quarter and in H1.

In most instances, headline asset-quality metrics improved. In a very productive quarter for NPL sales in Spain, stocks at CaixaBank, Sabadell, Santander and Kutxabank declined following transactions in both the secured and unsecured space. For most other lenders, flat net inflows on growing balance sheets translated into this metric improving both quarterly and over the year. NPL coverage levels are solid and mostly improving: Ibercaja and Kutxabank stand out with 81.6% and 100% (excluding contingent risks and prudential coverage).

Cost of risk was mostly in line or below initial guidance so most lenders left 2022 guidance unchanged. On average, CoR in Spain stood at 34bp, less than half compared to YE2020. BBVA and Bankinter adjusted downwards by 5bp to 25bp and 35bp respectively. Group cost of risk for BBVA and Santander was flat to marginally increasing with respect to YE2021 but still significantly below the 100bp guided for the year.

“Even though over 90% of State guaranteed lending is repaying and default rates are manageable, lenders are cautious given the potential impact from the deteriorating macro picture,” Romano said, adding that coverage levels are solid, as overlays have not been released. NPL ratios are trending down.

Solvency ratios remained relatively stable in Q2. Organic capital formation was solid, although distributions and buy-backs, RWA inflation and market effects (mainly valuation adjustments on available-for-sale portfolios) offset most of the increase.

Scope has subscription ratings on the following Spanish banks. To view the ratings and rating reports on ScopeOne, Scope’s digital marketplace, or to register, please click on the following links: