Announcements

Drinks

Ukraine: European multilateral banks need guarantees to play key role in funding reconstruction

By Alvise Lennkh-Yunus, Julian Zimmermann and Alessandra Poli

The European Commission (EU, AAA/Stable) proposed on 9 November another support package for Ukraine of up to EUR 18bn to cover a significant part of Ukraine's short-term funding needs for 2023. Beyond immediate budgetary needs in 2023, the EU can play a key role in financing the longer-term reconstruction efforts in Ukraine (CC/Negative) by mobilising up to EUR 350bn in loans without necessarily putting its AAA-ratings at risk.

However, as the EU lends only to governments, funding or co-funding Ukraine’s private sector in the reconstruction phase remains a challenge. Here, the European multilateral development banks (MDBs) come into play, in particular the European Investment Bank (EIB, AAA/Stable) and the European Bank for Reconstruction and Development (EBRD, AAA/Stable).

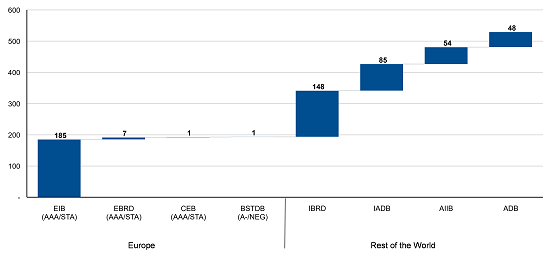

We estimate that European MDBs have available an overall lending headroom of around EUR 194bn under current leverage policies and utilisation levels (Figure 1). This capacity is heavily concentrated at the EIB, while the EBRD could mobilise up to EUR 7bn.

European MDBs’ lending headroom for Ukraine limited for now

At the same time, given capital adequacy policies and prudential lending limits, including country, single-name and sector concentration limits, a substantial increase in lending towards Ukraine is unlikely.

The EIB had outstanding loans in Ukraine of EUR 1.57bn at YE 2021, almost all of which are guaranteed by the EU via its External Action Guarantee Fund, which has limited additional headroom. The EBRD had total outstanding exposure in Ukraine of EUR 2.4bn as of H1-2022 and has committed up to EUR 3bn until 2023 to support the real economy.

Figure 1. Lending headroom of selected MDBs

EUR bn, at YE 2021

Source: Respective issuers, Scope Ratings. Lending headroom is defined as the maximum mandated assets under statutory limits or credibly enforced operational lending limits as of end-2021, minus outstanding mandated assets as of end-2021. Statutory limits are usually defined by MDBs as a multiple (usually between 1x and 2.5x) of subscribed capital, reserves and earnings.

Smaller European MDBs, such as the Council of Europe Development Bank (CEB, AAA/Stable) and the Black Sea Trade and Development Bank (BSTDB, A-/Negative) retain relatively limited additional lending headroom. Our estimates exclude the European Stability Mechanism’s (AAA/Stable) available lending capacity of EUR 413.8bn, as these funds can be used only for euro area countries facing financial difficulties.

For European MDBs to play a larger role in the reconstruction of Ukraine, they would need a new, dedicated EU programme like the guarantee currently covering the EIB’s lending outside the EU. Without one, the banks’ risk limits will significantly reduce the lending available to Ukraine.

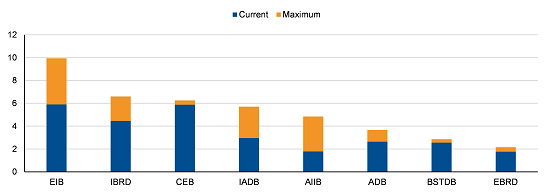

EIB, EBRD credit profiles could withstand substantial increase in activities

However, the risks to the EIB and EBRD of using a significant part of the available lending capacity are manageable given their excellent financial profiles and strong shareholder support. The EIB would become by some margin the most leveraged MDB among issuers included in this analysis if it took advantage of its financing headroom, while the EBRD would remain highly capitalised given its prudent lending limits.

Still, caution is warranted regarding the use of the additional headroom and preservation of other risk-related measures. Our estimates are upper-bound ceilings, since we assume that liquidity and funding profiles, the composition and asset quality of the lending portfolio, and shareholder ratings remain unchanged.

The actual lending headroom would shrink should any of these parameters change, which is likely. Demand for and the deployment of additional lending by MDBs will be higher in countries with weaker risk profiles, such as Ukraine. Using funds for riskier activities to develop new instruments and markets to absorb risks the private sector is unwilling to undertake to crowd-in private capital would also reduce the lending headroom. In addition, retaining a cushion above certain lending thresholds is credit positive, as it facilitates the counter-cyclical role of MDBs during economic and financial crises.

However, using up much of the spare lending capacity would also increase MDBs’ earnings potential, contributing to internal capital generation and higher liquid assets, strengthening MDB credit profiles.

Globally, MDBs have around EUR 530bn in lending capacity

Other institutions in addition to the EIB such as the World Bank (IBRD), ADB, IADB and AIIB have room to increase their lending activities by around EUR 340bn, assuming current leverage policies remain unchanged.

Figure 2. Leverage under current and maximum mandate-related assets

Mandated assets/Capital, %

Source: Respective issuers, Scope Ratings. Capital includes paid-in capital and reserves as of end-2021.

Our estimate of almost EUR 530bn in total MDB additional lending capacity is broadly aligned with other studies (see G20 review 2022, Munir et al. 2018, Humphrey 2018, Settimo 2017) considering comparable pools of MDBs and similar assumptions. This supports the G-20’s call for MDBs to optimise the use of their capital, boost investing capacity and adapt risk tolerance frameworks to support developing countries at times of multiple crises.

*"This is a re-published version of an article originally published on 16 November 2022, with some technical corrections to also reflect signed undisbursed amounts for the lending headroom calculations