Announcements

Drinks

Slovakia: political uncertainty and inflation to pressure an already weakened macro fiscal outlook

By Thomas Gillet, Associate Director, Sovereign and Public Sector

Scope Ratings revised Slovakia’s (A+) Outlook from Stable to Negative on October 28 in view of high energy supply risks, weakening macroeconomic prospects and greater political uncertainty.

The Slovak parliament dismissed Eduard Heger’s government on 15 December following a no-confidence motion introduced by Freedom and Solidarity (SaS), which withdrew from the ruling coalition in September 2022, leaving the government without a parliamentary majority.

The holding of early legislative elections in 2023 instead of February 2024 is one likely consequence as no major party seems to be in a position to form a new coalition. Any caretaker government appointed by President Zuzana Čaputová would lack the political capital to decisively address the energy crisis and introduce reforms, notably of Slovakia’s pension system. As the country’s population ages, pension liabilities are set to increase from 8% of GDP in 2019 to 13% in 2050.

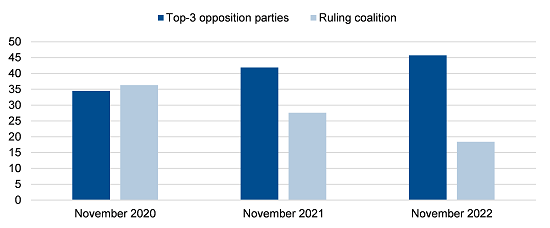

Figure 1. Support for the ruling coalition slips, while opposition firms up

Poll on the parliamentary elections, %

Note: top-3 opposition parties include HLAS, SMER, and PS

Ruling coalition includes OĽaNO, SaS, SR and ZĽ (2020, 2021) and OľaNO, SR and ZĽ (2022)

Source: Ipsos, Focus, Scope Ratings

Political instability threatens budget approval, measures to tackle rising cost of living

New elections could benefit opposition parties, leading opinion polls with a comfortable margin (Figure 1), triggering extra uncertainty over foreign and economic policy. More than 50% of Slovaks view Ukrainian refugees negatively (against 25% in Czech Republic; 15% in Hungary; 11% in Poland) and almost 40% consider that the US/NATO was responsible for starting the war, according to Slovak think-thank GLOBSEC.

As the case of Hungary (BBB+/Negative) has shown, friction between Brussels and EU capitals can imperil the disbursement of EU funds on which Slovakia remains reliant. Despite a low EU funds absorption rate in the past – around 50% – Slovakia’s economic growth should benefit from the drawdown of Recovery and Resilience Plan’s resources, amounting to EUR 6.3bn (c. 7% of GDP), with the request for a second EUR 708.8m disbursement submitted in October 2022.

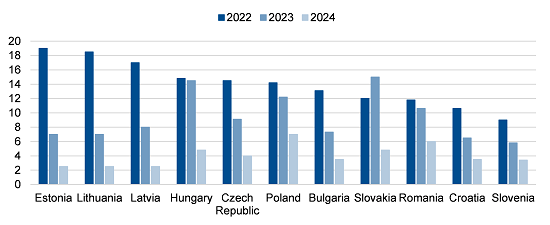

Meanwhile, delayed approval of the 2023 budget could leave households and business exposed to the worst effects of the energy crisis and rising inflation, even though the European Commission approved a EUR 600m scheme to support Slovak companies in November 2022. Inflation has run at 15% in 2023, up from 12% last year and the highest in the euro area (Figure 2).

Figure 2. Slovakia’s inflation on the rise, in contrast with most of CEE

%

Note: projections from Scope’s 2023 Central and Eastern Europe Sovereign Outlook

Source: Scope Ratings

Energy uncertainty, weak export demand weigh on growth prospects

An exemption from EU sanctions on Russia allowing Slovakia to import Russian oil via the Southern Druzhba pipeline through Ukraine until end-2023 should provide near-term relief. Even so, Russia is increasingly targeting Ukrainian energy infrastructure. Uncertainty around energy supply in the long run would keep inflation on the rise.

Slovakia seems to have secured enough gas for an average winter without importing from Russia due to a new pipeline through Poland. However, high energy costs are affecting industry, while a euro area in danger of recession will further reduce export demand, a risk for Slovakia’s small, open economy.

As investment projects are likely to be postponed until the second half of 2023 and 2024, Slovakia’s growth outlook will weaken further (with output rising only 0.5% in 2023 after 1.8% in 2022) particularly without an emphatic fiscal response to rein in price increases, increasing the pressure on its credit ratings.

Alessandra Poli, Associate Analyst, contributed to this commentary.