Announcements

Drinks

Norway: sharp rise in revenues from oil and gas activities, lower risk of stranded assets

By Eiko Sievert

The EU’s Energy Council agreed on a gas price cap at its 19 December meeting but finding the appropriate triggers and exact mechanics of a price cap proved to be controversial and the measure has raised financial stability concerns as it could lead to increased market volatility. It was the only open issue stalling a wider energy support package, including legislation for joint gas purchases by Member States.

While the agreed price cap will only be triggered in response to extraordinary price moves, combining the collective purchasing power of the EU should help to lower prices when negotiating with suppliers. This is likely to result in longer-term supply agreements to help improve planning certainty for households and businesses.

But it is unlikely to significantly weaken the positive impact of the energy crisis for energy suppliers such as Norway (AAA/Stable). Even if gas prices moderate over the coming years, continued high tax revenues from the oil and gas sector are expected to bolster the country’s public finances.

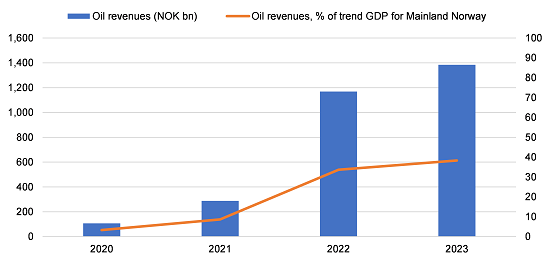

Under Norway’s fiscal framework, revenues from the petroleum sector are initially saved into the country’s sovereign wealth fund. The net cash flow from oil and gas operations is expected to increase fourfold, rising from NOK 288bn in 2021 (8.6% of mainland GDP) to NOK 1,169bn in 2022 (33.7% of mainland GDP) and NOK 1,384bn in 2023 (38.3% of GDP).

Figure 1. Norway’s oil revenue, 2020-2023

NOK bn (LHS), % trend GDP for Mainland Norway (RHS)

Source: Norwegian Government, Scope Ratings.

There are clear limits to how far the EU’s agreed measures can lower gas prices and they will not solve the continent’s energy crisis on their own. National support measures will therefore remain important. Large differences in the degree of budgetary flexibility, each country’s industry mix and the reliance on gas are factors that influence the wide divergence in the size of government support packages.

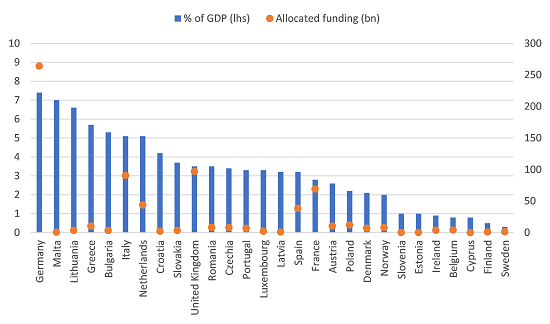

In total, European governments have already earmarked around EUR 705bn to support households and businesses from the energy crisis. The biggest support measures have been announced by Germany amounting to EUR 264bn (7.4% of GDP) compared with lower allocated funding by Italy (5.1%), the United Kingdom (3.5%), Spain (3.2%) and France (2.8%).

Figure 2: Governments earmarked and allocated funding (Sep 2021 - Nov 2022) to shield households and businesses from the energy crisis

Sources: Bruegel, public and private sector national sources, Scope Ratings.

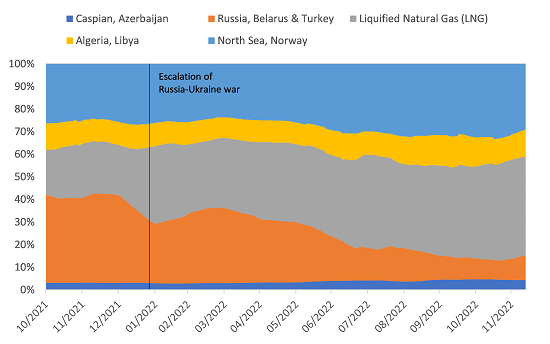

As European countries gradually shift away from Russian energy sources, they rely increasingly on liquified natural gas (LNG), mainly imported from the US, Qatar and Nigeria, which now makes up more than 42% of Europe’s gas supply. Since the escalation of Russia’s war against the Ukraine, Norway has established itself as the single most important gas supplier for the EU, providing around 30% of EU gas since the summer.

Figure 3: Gas supplies to Europe

% of total gas supply, monthly moving average

Sources: European Network of Transmission System Operators of Gas, Scope Ratings.

The growing importance of Norway for Europe’s gas supply also lowers the country’s stranded asset risk. Increased reliance from the EU and the use of gas as a transition fuel towards net-zero provides the Norwegian economy with ample time to diversify from its reliance on the oil and gas sector, as demand is likely to remain high in the medium term.

While Norway has postponed its 26th licensing round for new oil and gas fields until after 2025, this only applies to new unexplored areas. Existing areas on the Norwegian Continental Shelf will therefore continue to be developed. Recent forecasts by the Norwegian Petroleum Directorate show that oil and gas production are expected to stay at high levels over the medium term with gas production, in particular, set to remain near all-time highs every year until 2026.

Alessandra Poli, Associate Analyst, contributed to this commentary.