Announcements

Drinks

Spain: sovereign borrowing costs contained despite rise in yields, tighter ECB policy

.jpg) By Jakob Suwalski, Director, Sovereign Ratings

By Jakob Suwalski, Director, Sovereign Ratings

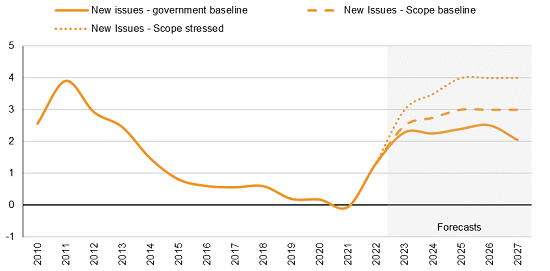

Even in an unexpected ‘stressed’ scenario in which the cost of new debt issuance increased sharply, the average cost at issuance would hover around 4% in 2024. This would be still 1.5 percentage points higher than assumed by the Spanish Treasury (Figure 1) – and at similar levels Spain (A-/Stable) had to offer in the aftermath of the global financial crisis and during the euro debt crisis when the country’s public finances and housing market were on a weaker footing than today.

Spain’s higher issuance costs are partially offset by the retirement of higher-yielding bonds and the lengthening of the average maturity of government debt, which currently stands at 7.9 years compared with 6.2 in 2012.

The economic outlook is also relatively robust despite the headwinds of inflation and tighter monetary policy, with Spain set for GDP growth of 1.3% this year, better than the euro area average. We are also confident that the Spanish Treasury will attract private-sector investors to Spanish bonds as the ECB winds down its asset purchases, a view supported by strong demand in latest auctions.

Figure 1: Debt issuance costs contained: yield on new Spanish 10Y government bond issuance

%, 2010-27F

Source: Ministry of Finance Spain, Scope Ratings, Our ‘stressed’ scenario assumes a severe recession in the euro area and more rapid monetary tightening.

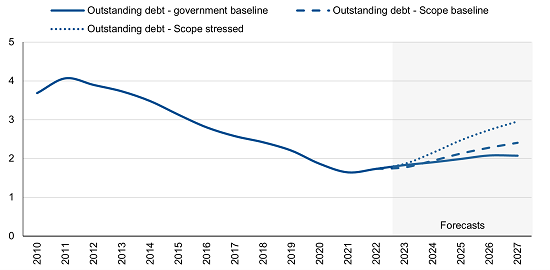

To be sure, Spain’s overall borrowing costs are going to rise as financial markets continue to adjust to the post-pandemic environment of higher inflation and tighter monetary policy, but the increase in the cost of servicing outstanding debt will remain moderate.

Average yields on Spain’s debt will rise from today’s 1.73% but remain below 3.0%, even in a stressed scenario assuming the government carries out gradual but sustained fiscal consolidation (Figure 2).

Compare that with Italy (BBB+/Stable), with average cost on its outstanding debt at 2.9% at end-2022, up from 2.5% in 2021. Indeed, relative investor confidence in the credit outlook for Spain is visible in the narrower spread of 10Y Spanish yields over Bunds compared with Italian bonds.

Figure 2: Moderate rise in Spain’s debt servicing: average yield on outstanding debt

%, 2010-27F

Source: Ministry of Finance Spain, Scope Ratings, Our ‘stressed’ scenario assumes a severe recession in the euro area and more rapid monetary tightening.

Much of the nearer-term uncertainty on the outlook for public finances in the euro area surrounds the degree of monetary tightening to come, notably the scale and speed of the ECB’s quantitative tightening, and the liquidity drain that comes with it.

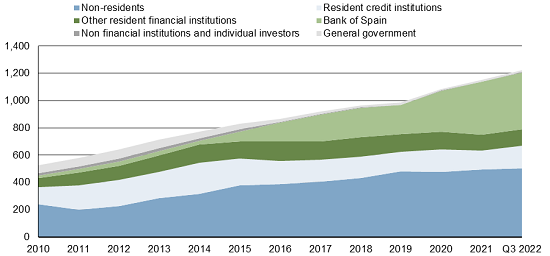

The ECB has de facto stabilised the market for the euro area sovereign debt through bond purchases, with Spain no exception. In Q3 2022, the ECB held 34% of Spain’s outstanding government debt (Figure 3) – hence the importance of private-sector bond purchases in future.

Figure 3: ECB’s ballooning ownership of Spain’s sovereign debt

EUR bn, 2010-22

Source: Ministry of Finance Spain, Scope Ratings

We expect the ECB’s quantitative tightening to be gradual while private demand for euro area government bonds should be supported by significantly higher interest rates compared with a year ago. Contrast that with the aftermath of the euro area debt crisis in 2010-12: only in 2015 did the ECB begin to buy debt to compensate diminishing private-sector demand.

The Spanish Treasury plans to issue EUR 70bn of net debt this year, little changed from 2022 and EUR 5bn less than initially planned due to better-than-expected tax collection. The Treasury plans issuing more green bonds for which investor appetite remains strong, which should help contain increases in coupons.

Underlying inflationary pressures set to endure

The inflation outlook is another area of uncertainty, with the euro area’s running well above the ECB’s 2% target. Annual consumer price inflation declined in Spain to 5.8% in December due to favourable energy prices but underlying inflationary pressures will take time to subside.

Longer term, the upcoming redesign of fiscal rules in the euro area is important for sustainability of the Spanish debt. Simpler, more flexible rules would be credit positive. Latest proposals by the European Commission include keeping the public deficit target of 3% of GDP but allowing greater budgetary flexibility to place debt on a downward trajectory depending on a country’s debt-to-GDP ratio.

While added flexibility to adjust public debt is sensible, for Spain, keeping the 3% deficit rule will be a challenge for the next government following this year’s elections. We project a deficit of 3.5% by 2024, unless the government introduces additional measures to enhance revenues and/or cut expenditure to help offset higher interest payments.