Announcements

Drinks

European retailers: persistent inflation, low consumer confidence threaten demand, squeeze margins

By Claudia Aquino, Associate Director, Corporate Ratings

Credit quality for companies in the sector covered by Scope has worsened since Q4 2022. Most rating actions resulted either in a downgrade, outlook change to negative from stable, or placement under review for possible downgrade.

Pressure on profitability from more frugal consumer behavior and inflation, particularly costs, was one important driver of the negative rating actions alongside the impact of increasing net working capital due to overstocking. Rising interest rates have led to the deterioration in Scope-adjusted EBITDA interest cover.

Volumes in the European retail market have shrunk since the beginning of 2022, according to Eurostat, a trend that continued in Q2 2023. We expect the negative trend to persist at least until end-2023, consistent with the loss of consumer purchasing power.

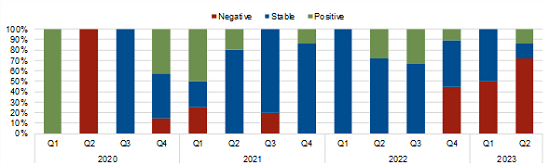

Figure 1: Scope rating actions* for European retailers, 2020 to Q2 2023

*Positive: Outlook change to Positive from Stable or Stable from Negative; Upgrade, under review for possible upgrade

Negative: Outlook change to Negative from Stable or Stable from Positive, Downgrade, under review for possible downgrade

Stable: Affirmation, under review for developing outcome

Larger retail group better positioned to rebuild profit margins

Larger, established retailers such as Ceconomy AG, Fnac Darty SA and Ahold Delhaize NV, are better positioned to rebuild margins, benefiting from geographical diversification and multiple product line-ups. They are also able to offset the declining volume at least partially with complementary and ancillary services as well as sales of own-label products which tend to generate higher margins. Another advantage is operating flexibility to exploit opportunities in new markets and product segments.

E-commerce remains a threat as online platforms continue to grab market share from incumbent bricks-and-mortar retailers.

In response, retailers will need to continuously develop omnichannel sales – requiring increased capital expenditure to digitalise their business – to reach a larger market and collect information to improve customer retention which will be crucial to maintain market share. As an example, Ceconomy is heavily investing in customer retention and part of the strategic plan is to increase sales with loyalty members by 60% within FY 2025/26. The group expect to achieve this goal through the launch of myMediaMarkt concept in eight countries by FY 2024/25 and the extend the omnichannel communication platform in all countries by FY 2023/24.

Weak margins and increased cost of financing will make it difficult for smaller retailers to finance these investments amid pressure on leverage and interest cover. Retailers with large amount of debt on floating interest rates are most vulnerable to rising financing costs.

Default risk is growing too. Based on our recent research on retail bankruptcy in Europe (Retailing bankruptcy risk grows in Europe: business failures to rise after slowdown in 2021-2022, April 2023) 57% percent of bankruptcies related to fashion-sector SMEs and 13% in DIY and home-appliance stores which faces fiercest competition from online retailers and heavy investment to remain competitive.

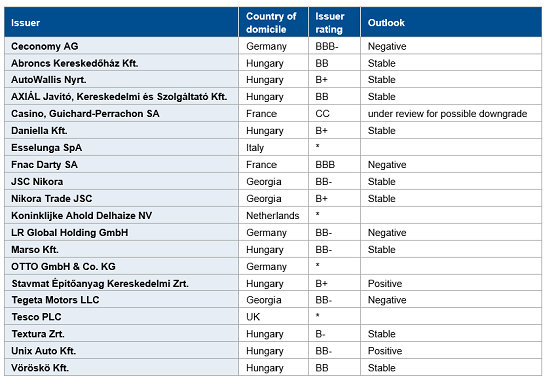

Figure 2: Scope’s coverage of retail and wholesale corporates

* Subscription ratings available on Scope’s digital platform ScopeOne.

Source: Scope

Scope’s recent retail-sector research:

Scope Ratings publishes final rating methodology for retail and wholesale corporates; April 2022