Announcements

Drinks

Polish covered bond issuance expected to surge in next two years

By Mathias Pleissner, Deputy Head, and Karlo Fuchs, Head of Covered Bond Ratings

The run on Silicon Valley bank must have been a wake-up call for the KNF, which has published resolution 243/2024, its verdict on how domestic banks can avoid unbalanced refinancing structures and reduce financial stability risk. The resolution will help banks lengthen their liability profiles. From January 2027, Polish banks will have to refinance 40% of qualifying residential mortgages with longer-term liabilities and equity.

This has become vital as the stock of Polish residential mortgages increased 17-fold between 2003 and 2023 to reach EUR 108bn. To-date, mortgages have been predominantly deposit funded. Neither the nascent Polish covered bond market nor other capital market debt have been instruments of choice to refinance them.

WFD: the long-term funding ratio

The long-term funding ratio (Wskaźnika Finansowania Długoterminowego, WFD) that has been introduced has some interesting credit features that have the potential to shape Polish mortgage lending and capital markets.

Looking at the denominator, the KNF wants to ensure that borrowers will not be significantly exposed to payment shocks from rising interest rates and that banks incentivise borrowers to take out fixed-rate mortgages. Until 2022, residential mortgages were mainly floating-rate, although that has now changed. The WFD denominator features a lower weighting for fixed-rate mortgages (90%) than for floating-rate mortgages (100%), which should stabilise the higher share of fixed-rate mortgages.

For the 40% threshold, the KNF has given banks sufficient freedom on how they refinance. They can use:

- Equity in excess of regulatory requirements,

- MREL-eligible securities,

- Non-callable long-term debt instruments,

- Retail deposits with a contractual maturity of more than two years,

- Covered bonds.

Each refinancing option has weights attached, which banks will have to take into account when determining their refinancing mix. Excess equity will attract a weighting of 1.4x and will be the initial option of choice. It Equity not available to meet the ratio over the long term, however, as its weighting will reduce over the next seven years by 0.2x each year until it reaches zero.

To foster climate transition, KNF is the first regulator we are aware of that is explicitly seeking to foster green bonds that comply either with the EU Green Bond Standard or the Green Bond Principles. Any bond that complies with these standards attracts a 20% higher weighting (1.2x) than conventional bonds.

Other options (items 2-4 above) have time-dependent weightings attached that should lead to better matching of assets and liabilities. Debt with maturities below three years has a lower weight (down to only 90% for maturities of one year) while debt with a maturity of below one year is not counted at all. The longer the maturity, the higher its weight for the WFD. Maturities above five years receive a 10% higher weight.

Boost to Polish covered bond market

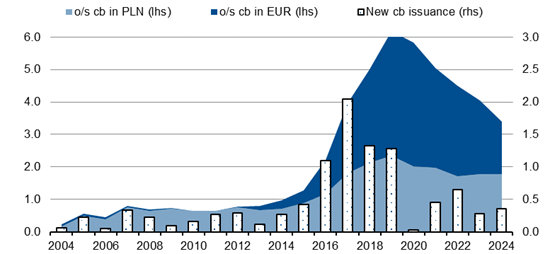

The Polish covered bond market saw a short-lived period of growth some years ago. It peaked with an issuance volume of EUR 2bn in 2017 and outstandings of EUR 6.2bn in 2019.

Figure 1: Polish covered bond volumes and outstandings

Source: ECBC, Bond Radar, Scope

There have been expectations of market growth before. In fact, we published a report on Polish covered bonds almost five years ago (Polish covered bonds: a lot of green lights but challenges remain). Most of the credit themes that investors were worrying about then, like the FX-denominated mortgages saga that cost the banks dearly, can be looked at from a position of relative comfort today. The WFD will likely be the prod the market needs.

Covered bonds could be the instrument of choice for banks to build up their WFD ratios. When funding long maturities, covered bonds are the go-to and most cost-efficient debt instruments for banks. ESG credentials have added appeal. New buildings and the mortgages used to finance them easily comply with high energy standards due to enhanced building standards, while renovating old buildings will typically raise their energy-efficiency ratings. Both can be used to build up sufficient collateral pools to support compliant green bonds.

From a credit and macroprudential perspective, better matching of assets and liabilities will improve financial stability, and increasing fixed-rate and long-term mortgages will help to cushion borrowers from affordability shocks. Reaching the 40% threshold will not happen overnight but we believe it is credit positive and will also help support the growth of the Polish covered bond market and keep that growth constant.

Stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.