Announcements

Drinks

European Bank Capital Quarterly: regulatory landscape evolves

“Large European banks maintain adequate buffers to regulatory requirements, have the capacity to generate retained earnings, and have adopted various mitigation strategies,” said Magnus T Rising, an analyst in Scope’s FI team.

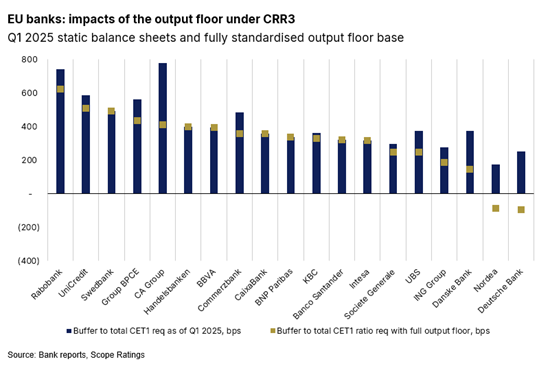

The greatest CET1 impact is seen with the Credit Agricole group, although given the group’s sizable buffer to its total CET1 ratio requirement, the impact at group level should be easily absorbed. Of the banks in our sample, only Deutsche Bank and Nordea would fall short of their respective CET1 ratio requirements if the output floor and all changes to the standardised approaches were applied overnight. But, in business-as-usual scenarios, we would expect both banks to be able very quickly to generate the capital increases required through retained earnings, portfolio optimisation and other measures.

Swiss TBTF proposal: a double-edged sword

Swiss TBTF proposal: a double-edged sword

The amendments to the Swiss Too Big To Fail regime, including full CET1 deduction of the carrying value of foreign subsidiaries of Swiss systemically important banks, is intended to improve room for manoeuvre in a crisis, including the possibility to divest foreign subsidiaries without compromising a parent bank’s ability to meet capital requirements. But it will have profound implications for UBS.

To bring UBS AG’s CET1 ratio up to the lower end of the 12.5%-13.0% CET1 ratio target would require a CET1 capital build-up of USD 24bn. This will constrain growth opportunities and could have business-model implications. The Swiss proposal is severe compared with the capital treatment of financial subsidiaries for banks in the EU and would put UBS on a yet more unequal footing.

“That said, the proposal would eliminate double leverage and should prevent impacts on the parent bank’s CET1 capital from valuation losses on foreign subsidiaries by technically insulating the group’s regulatory capital position from troubles abroad. As such, it would represent a significant credit strength for UBS relative to other large European banking groups,” Rising said.

“In the near to medium term, though, there could be negative implications from a possible weakening of the group’s competitive position arising from a greater cost of capital in nominal terms and more constrained growth opportunities,” Rising added.

FRTB delays

In the EU and the UK, delays have been proposed to implementation of the Basel III Fundamental Review of the Trading Book (FRTB) for market risk. The European Commission has adopted a delegated act to postpone the application date by an additional year to 1 January 2027.

The UK Prudential Regulation Authority proposed further delaying the final FRTB Internal Model Approach (IMA) to the beginning of 2028, highlighting IMA as the most relevant part of the FRTB for cross-border co-ordination, given the cost and complexity of running different models. Other elements of the FRTB, including the alternative and simplified standardised approaches, will still be implemented on 1 January 2027 alongside other parts of Basel III finalisation.

“EU and UK delays to FRTB implementation were prompted by uncertainties about how it might be implemented elsewhere and concerns about an internationally level playing field,” Rising noted.

US aligning with Basel

US regulators have yet to adopt the Basel III Endgame, even though phase-in was originally intended to have begun on 1 July 2025. “The emphasis has shifted to broader perspectives, including concerns about economic growth, regulatory complexity, and US banks’ ability to compete globally and against non-bank financial firms,” Rising said.

The US proposal is likely to be significantly revised and will very likely be made at least capital neutral in impact rather than raise CET1 capital requirements by 16%-19% as was anticipated with the original proposal. “This does not necessarily imply less alignment with Basel standards. Disagreements about the proposal have largely centered on US gold plating of international standards that impose greater capital requirements on US banks,” Rising explained. “In fact, developments point to possibly greater US alignment with the Basel framework.”

For example, US regulators have proposed a rule to lower the enhanced Supplementary Leverage Ratio (eSLR) buffer requirement for US G-SIBs, which will align their ratio requirements with Basel and the requirements of EU peers.