Announcements

Drinks

Italian Bank Quarterly: strengthening business models amid less favourable earnings outlook

Our sample of eight Italian banks – Intesa Sanpaolo, UniCredit, Banco BPM, Banca Monte dei Paschi di Siena, BPER Banca, Mediobanca, Credito Emiliano and Banca Popolare di Sondrio achieved a return on average equity of 16.6% in the third quarter, up from 15.6% in Q2 2024 and 14% in Q3 2023.

“However, the normalisation of net interest margins will continue in 2025 and will have a negative impact on profitability. Against this backdrop, Italian banks are strongly committed to boosting non-interest income and making their business models more resilient to the interest-rate cycle,” said Alessandro Boratti, lead analyst for Italian banks. “But while fees and commissions will continue to grow, reflecting banks' efforts to expand capital-light activities, this growth will be insufficient to offset the decline in net interest income,” Boratti cautioned.

The main downside risk to profitability, especially beyond 2025, is the possibility that the ECB will cut policy rates below 2%, a level currently seen by many as the terminal rate. We cannot rule out a return to monetary stimulus, as growth prospects in the euro area are challenged by a struggling manufacturing sector and a sluggish German economy. Donald Trump's emphatic win in the US presidential election adds to the downside, given the proposed 10% tariff on all EU imports.

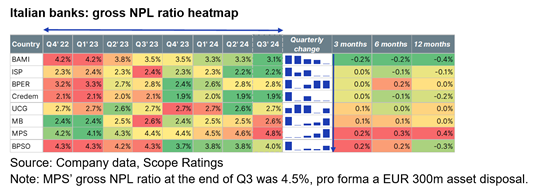

Asset quality remains solid. The average gross NPE ratio of 3% has remained stable since Q1 2024. “We do not expect a material deterioration as macroeconomic conditions remain supportive for both retail and corporate credit. With easing borrowing costs and employment at record highs, we see the retail loan book performing well. At the same time, low but positive economic growth should support corporate credit quality,” Boratti said.

Default rates have risen only marginally from record lows in 2024. The contained increase reflects a mix of factors: a large proportion of fixed-rate mortgages shielding retail borrowers from higher interest rates, companies using liquidity buffers accumulated during the pandemic to reduce leverage and absorb the impact of higher cost of goods and energy; and banks’ improved credit origination and monitoring standards.

Default rates have risen only marginally from record lows in 2024. The contained increase reflects a mix of factors: a large proportion of fixed-rate mortgages shielding retail borrowers from higher interest rates, companies using liquidity buffers accumulated during the pandemic to reduce leverage and absorb the impact of higher cost of goods and energy; and banks’ improved credit origination and monitoring standards.

At the end of Q3, Italian banks’ average fully loaded CET1 ratio hit a new high of 15.9%, up almost 40bp QoQ. The quarterly improvement was driven by organic generation and lower risk weighted assets.

Capital efficiency was a key driver of Banco BPM’s bid to acquire the remainder of Anima, Italy’s largest independent asset manager. Under the Danish compromise, the regulatory arrangement made permanent under CRR 3, banks are not required to fully deduct significant investments in insurance firms from capital calculations. This has paved the way for the creation of more financial conglomerates in the EU.

Assuming the acquisition goes ahead, the impact of BPM’s CET1 ratio would be limited to around 30bp. The lender’s move is consistent with its strategic plan to enhance the turnover generated by its product factories. “We deem the deal to be positive as it would lead to a more diversified business profile, potentially reducing earnings volatility over the cycle,” Boratti said. Core revenues would rebalance towards fees and commissions, from 37% of core income in 2023 to more than 45% in 2026.

Download the Italian bank quarterly here.

Scope has public ratings on the following Italian banks:

Scope has subscription ratings on the following Italian banks. To view the ratings and rating reports on ScopeOne, Scope’s digital marketplace, or to register, please click on the following links: