Announcements

Drinks

Norway: positive credit implications from banking sector consolidation

The most commonly cited goals of bank mergers have been strengthening market positions and the need for scale to better compete for customers while managing ever greater regulatory demands. Scope expects savings banks will continue to dominate Norwegian bank M&A activity. If the current pace of consolidation is maintained, the number of savings banks will decline from 80 to around 50 by the end of the decade.

For smaller banks in particular, mergers provide the economies of scale needed to remain competitive in an evolving financial landscape, while some deals also offer the benefits of broader business models in terms of geographical diversification and additional service offerings. “The economic benefit of greater scale is substantiated by our analysis, particularly for the smaller banks” said Magnus Rising, an analyst in Scope’s financial institutions team.

“When it comes to further consolidation, if customer behaviour further shifts towards digital solutions and commoditised service offerings and the market becomes increasingly national, we would expect the pace of mergers to intensify,” added analyst Andre Hansen. “But if the strategy of emphasising local relationships and physical presence continues to be successful, even in markets where digital solutions dominate, consolidation may slow.”

Several structural factors may also prevent consolidation from progressing at an even faster pace.

First, Norway’s savings banks operate locally or regionally. Takeovers of banks in distant regions are not feasible in terms of local market expertise and risk management strategy. Despite the high degree of commoditisation implied by the highly digitalised service offerings of Norwegian banks, several savings banks have increased the number of local or regional branches in recent years.

Second, despite high concentrations in low-risk lending segments and the additional costs associated with maintaining a local physical presence, Norwegian savings banks consistently generate better total asset returns than comparable Norwegian banks and European peers because of higher net interest margins. “This adds credibility to the value proposition of the local, relationship-driven approach. For many banks, robust returns may moderate the need to consolidate,” Rising said.

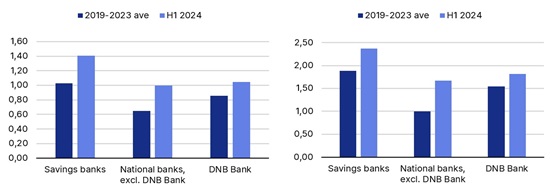

Return on average assets (%) and net interest margin (%)

Note: Norway domiciled banks. Consumer banks and pure play commercial banks not included.

Source: SNL; Scope Ratings

Third, most Norwegian savings’ banks are members of alliances that already provide significant economies of scale. These are achieved in part through shared product companies (e.g. asset management, non-life insurance, consumer finance, and leasing) for which member banks act as distributors. These alliances also share covered bond vehicles, technology solutions, and regulatory expertise.

Fourth, supporting and engaging with local communities are defining features of the savings banks. It is not uncommon for management to express a preference for remaining local and for local ownership.

“Finally, we believe the governance structures of savings banks may be slow the pace of mergers, even when deals would create clear equity value,” said Hansen. Equity holders do not ultimately control the savings banks, as their representation is limited by statute to 40%. Supervisory boards comprise representatives of depositors, employees and, in some cases, elected local government officials as well as equity investors.