Announcements

Drinks

BPCE’s joint venture with Generali supports business diversification and profitability

By Carola Saldias Castillo, Financial Institutions

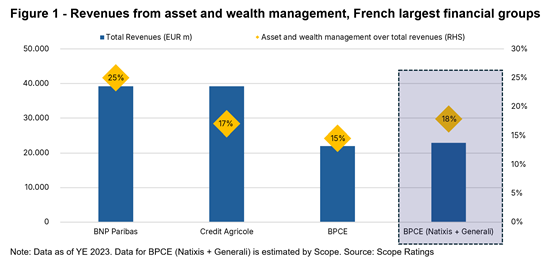

Business diversification by French banks remains a key strength and a driver of sustainable growth. French banks benefit from well-diversified business models, generating significant revenues from corporate and investment banking (CIB), wealth management and bancassurance. This is a business-model strength that distinguishes French banks from their EU peers.

Recent strategic acquisitions have demonstrated their ability to strengthen their already well-diversified business models. French banks have also been pursuing growth opportunities outside France, focusing on bolt-on acquisitions in existing markets like Italy and Belgium rather than pursuing aggressive expansion into new markets.

BPCE strategic plan drives expansion

BPCE’s 2030 strategic plan supports this drive for expansion. Its acquisition of Societe Generale Equipment Finance (gross loans of EUR 15bn included under the MoU), is expected to complete in the first quarter of 2025. Together with the acquisition of Bank Nagelmackers in Belgium, we view these transactions as a consistent execution of BPCE’s strategic ambitions.

BPCE mainly operates in France, where it had 76% of its total credit exposure as of June 2024, and where it is the second-largest banking group with a market share of customer loans and deposits of roughly 22%. The group’s co-operative structure underpins the group’s business mix. This is mainly composed of retail banking and insurance, which represented 70% of gross operating income as of 9M 2024, followed by 15% from asset and wealth management.

We estimate that the joint venture with Generali could increase the asset and wealth management share of revenues to 18%-22% of total revenues at group level. In terms of Assets under Management (AuM), the joint venture will position the group as the second largest player in Europe with EUR 1.9trn in AuM, surpassing BNP Paribas (EUR 1.5trn, including AXA Investment Managers) and closely behind Credit Agricole, where Amundi remains the leading player with EUR 2.2trn as of September 2024.

BPCE to become less dependent on French retail banking

The joint venture with Generali will strengthen BPCE’s business model by reducing its reliance on French retail banking revenues. This lowers the correlation of the bank’s operations with the performance of the domestic economy and adds a stabilising component to its earnings profile.

While this transaction does not materially alter BPCE’s geographic diversification in terms of banking assets or credit exposures, we expect the revenue distribution to improve with the potential of higher and more stable earnings capacity in the medium to long term.

Profitability metrics likely to improve, reducing gap to French peers

We do not expect the Generali transaction to increase BPCE’s risk-weighted assets, so it supports improvements in BPCE’s profitability metrics, helping to reduce the gap with peers in terms of return on assets and return on equity.

BPCE has historically reported weaker profitability than peer French banking groups, partly due to a large share of fixed-rate mortgages (55% of total loans in Q3 2024) and a lower relative share of commercial loans that reprice more quickly. French banks with larger CIB components have benefited from a relatively faster repricing of their loan books.

While the full benefits of this transaction are not imminent for BPCE’s credit profile, it does allow the group to gradually reduce the gap to larger French players. This transaction is another example of the market consolidation in European financial services. Others include the potential acquisition of Banco de Sabadell by BBVA in Spain, and of Commerzbank by UniCredit in Germany.

We expect further consolidation activity in 2025 as banks look for ways to strengthen their business positions and boost revenues in the face of a less supportive interest-rate environment.

See also:

French Banks Outlook: Fundamental support profitability; political uncertainty clouds loan growth

UniCredit: Commerzbank takeover unlikely without German government approval

BBVA’s Sabadell bid reflects solid prospects for Spanish Banking sector