Announcements

Drinks

European rearmament plans: national policy choices will shape fiscal impact

By Thomas Gillet and Eiko Sievert, Sovereign and Public Sector

France (AA-/Stable), Germany (AAA/Stable) and the UK (AA/Stable) will be among the leading NATO member countries to compensate for the increasingly uncertain commitment of the United States (AA/Negative) to guarantee Europe’s security.

The credit implications of higher defence spending from the three governments will be mixed, reflecting the differing fiscal positions, budgetary and socio-political constraints.

Relying on debt-funded military spending would weaken sovereign credit outlooks in France and the UK, but the combination of limited fiscal flexibility and higher bond yields could encourage both governments to make necessary budgetary adjustments. In addition, Germany’s fiscal stimulus could have broader favourable spillover effects on growth, which would help soften the permanent impact of increased European defence expenditure on public debt ratios.

Germany will rely predominantly on higher debt issuance to offset decades of underinvestment in its armed forces as the incoming administration secured a two-thirds parliamentary majority to reform the constitutional debt brake. Robust public finances, anchored by a debt-to-GDP ratio of 63% and a budget deficit of 2.0% of GDP in 2024, provide sufficient flexibility to finance Germany’s large fiscal stimulus without significant tax hikes or spending cuts in other areas.

The UK is likely to finance higher defence spending through a mix of debt issuance and some budgetary adjustments, given its debt burden of 101% of GDP and budget deficit of 5.4% of GDP. The government’s comfortable majority in parliament could offer flexibility to raise tax or reduce non-defence expenditures, or both.

Conversely, France faces limited capacity to absorb higher defence spending through additional debt issuance, given an already high debt-to-GDP ratio of 113%. Despite a budget deficit of 6.0% of GDP, making other budgetary trade-offs are equally challenging due the country’s minority government, highly fragmented parliament and relatively high risk of further political instability.

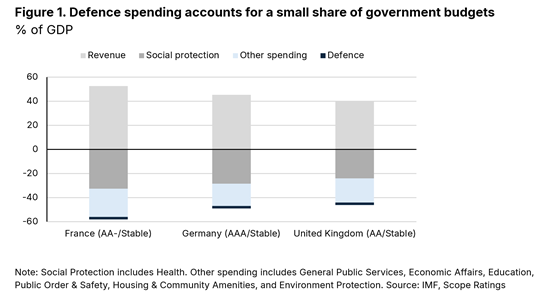

Shifting budget to finance higher defence spending

Increasing defence spending towards a potentially revised NATO target of 3% of GDP by 2027 would mean that annual spending allocated to armed forces increases to about EUR 95bn in France and the UK, and to above EUR 140bn in Germany.

This would represent an increase in defence spending averaging EUR 45bn a year until 2027 in Germany (0.9 percentage points of GDP), that is expected to be almost exclusively covered by higher funding volumes, without material credit implications.

However, increasing annual funding volumes by EUR 30bn in France (0.9pp) and EUR 20bn (0.7pp) in the United Kingdom would weigh on fiscal sustainability, particularly amid less favorable funding conditions, calling for potential budgetary trade-offs.

Bridging the spending gap towards a 3% of GDP defence target would be equivalent to about 3% of what France and the UK allocate to social welfare and less than 2% of revenue.

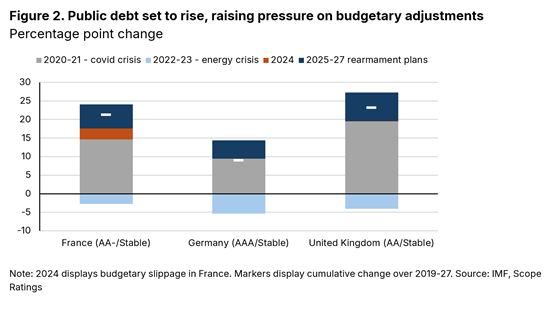

Bolstering European defence will impact debt ratios

Although budgetary trade-offs in France and the UK could partially offset credit implications, we expect increased debt issuance to be the main driver of higher defence spending in the three countries.

Assuming an increase of defence spending to near 3% of GDP by 2027, debt-to-GDP would rise to 120% of GDP in France, 109% in the United Kingdom, and 69% in Germany. This would represent a significant increase from pre-Covid levels, notably for France (21pp) and the UK (23pp).

The debt trajectory of both countries is particularly exposed to wider primary deficits, and higher interest rates triggered by the market reaction to Germany’s rearmament and infrastructure spending plans. Inflationary pressures could increase further with rising tariffs on critical inputs for the defence industry.

Annual funding programmes are thus likely to remain close to record highs by 2027. Net interest payments are projected to exceed 5% of revenue in France and 7% in the UK, though remain less than 3% in Germany.

Rearmament plans could moderately support growth outlook

Germany’s decision to take advantage of its large fiscal stimulus could also lead to positive spillovers for growth in France and the UK. Both countries have comparatively stronger military and defence production capacities, including nuclear deterrence.

This could result in slightly higher growth rates and, together with budgetary trade-offs mitigate the credit implications from higher defence spending.

However, potential regional economic spillovers could be limited by administrative and capacity constraints across European manufacturers. This could result in Germany’s rearmament plans being more reliant on increased US-supplied arms imports.