Announcements

Drinks

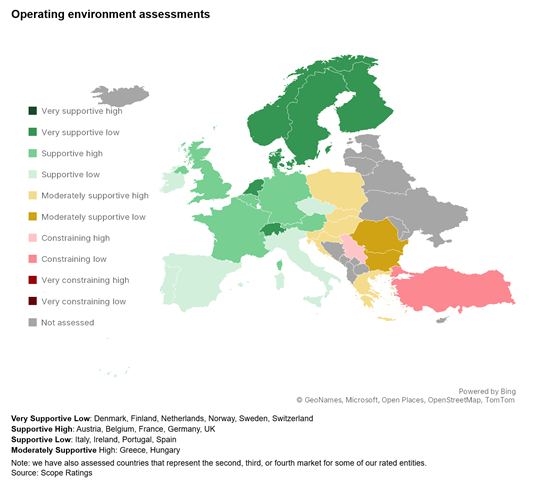

European bank operating environments 2025: resilient picture despite macro and trade uncertainties

Scope’s Operating Environment Assessment Handbook summarises our views on 17 European countries in which we rate financial institutions. Scope initially maps banks in a notch-specific range of ‘b-‘ and ‘a’. The riskiness of an issuer’s operating environment is then categorised through one of five qualifiers and further refined through a high or low modifier to a 10-degree scale ranging from Very Supportive (High) to Very Constraining (Low).

“Convergence in operating environment assessments across Europe is a reflection of harmonised supervision that has in turn driven significant convergence in bank KPIs,” said Marco Troiano, head of financial institutions. “While differences remain at individual bank level driven by business models and other factors, country averages for asset quality, solvency, profitability and funding have tended to converge.”

Uncertainties cloud the outlook

While the overall picture looks resilient, US policy unpredictability is creating some uncertainty around the outlook for European banks. Tariffs are likely to have a direct impact on Europe’s growth and interest-rate outlook, and therefore on the performance of European banks. Asset quality is likely to deteriorate, driven first by corporate loans exposed to US trade dynamics and then by second-round effects on households and SMEs.

“Lower interest rates will put downward pressure on bank margins and profitability, reversing the improvements since 2022 driven by the sharp rise in rates that allowed European banks to deliver improved profitability and the capacity to generate capital organically. Lower rates will be a headwind on both counts,” Troiano said.

“Beyond the immediate impact of tariffs, we are monitoring US policy shifts around broader financial policy, including potential changes of bank regulation, interference in monetary policy independence and changes to the framework of international co-operation safeguarding financial stability,” Troiano added.

Convergence in regulatory, supervisory and crisis management has been facilitated by moves towards the European Banking Union, as it has created exposure to the same monetary policy, fiscal rules, and lender-of-last-resort facilities. “Though still incomplete, we consider the banking union a credit-positive factor,” Troiano said.

Domestic economic factors and policies play a big role as drivers of economic KPIs. “While there is a degree of overlap between our sovereign ratings and our assessments of bank operating environments, the relationship is not mechanistic. Sovereign ratings are taken into consideration but they are one of many factors at play in our bank assessments,” Troiano said.

Download the Operating Environment Assessment Handbook here.

Download Scope’s Financial Institutions methodology for more information about the Operating Environment Assessments.