Announcements

Drinks

TLTRO changes signal significant ECB regime change

Most banks are well positioned however; many would have redeemed their excess liquidity from June 2023 anyway. Many only drew down TLTRO funds to take advantage of incentives that have already expired and their benefit for regulatory requirements such as the Net Stable Funding Ratio (NSFR) reduces as they approach maturity.

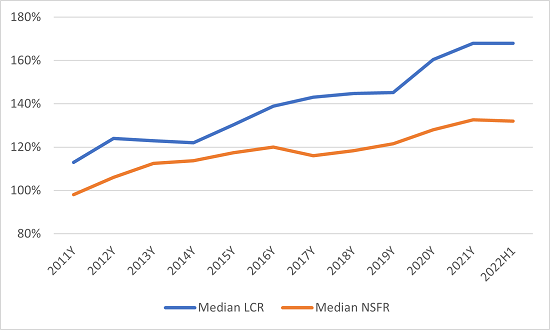

The Liquidity Coverage Ratios (LCR) and NSFRs reported by large banks are well above the regulatory minimums (see Figure 1), suggesting ample capacity to reduce liquidity. Thus, while the funding metrics of European banks will decline over the coming months, this reflects a normalisation of the system rather than another crisis.

Figure 1: Liquidity position of major euro area banks

Source: SNL, Scope calculations, Sample of 50 large euro area banks

The ECB’s sudden retroactive application weakens the credibility of the TLTRO tool, even if the changes are consistent with the ECB’s intended monetary policy stance. The new conditions that tie TLTRO borrowing costs to the deposit facility rate for most banks ensure that rising policy rates are transmitted through the system. Lower TLTRO borrowing may help to address imbalances in money markets by freeing up scarce collateral.

For as long as the ECB continues reinvesting its bond holdings under its asset purchase programmes, significant excess liquidity will remain in the system that will get remunerated. We do not expect banks to redeem their entire TLTRO borrowings early, so liquidity will only drop gradually over the coming quarters.

Less bank liquidity, nevertheless, implies further tightening of financial conditions into an economic slowdown. The ECB’s Bank Lending Survey already shows that banks tightened their credit standards and that loan demand is shrinking.

Central banks have already induced significant financial tightening this year and there is the risk that rising funding premiums will further reinforce this trend, especially as smaller banks in Italy or Spain – where excess liquidity is limited – start looking for market liquidity.

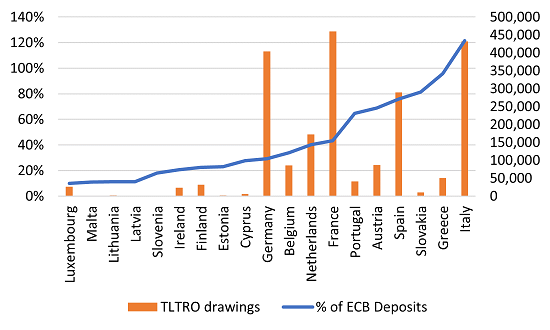

Figure 2: TLTRO drawings % of excess liquidity

Source: ECB, Scope calculations

Reserves are unevenly distributed across euro area banks and there are large differences between countries and individual banks (see Figure 2). While large banks have significant amounts of excess liquidity and diverse funding bases, smaller banks may be negatively affected, especially in regions with lower excess deposits, such as Spain, Italy or Greece. Banks may also wish to hold higher levels of excess liquidity in view of deposit outflows as rates go up.

We would therefore expect the main early repayments to be concentrated on Germany, France and Benelux, which account for around 50% of TLTRO outstandings and which would still retain substantial excess reserves even after fully extinguishing their TLTROs. We also note that German, French and Austrian banks have been more active in covered bond issuance this year compared to previous years, preparing the ground for repayments.

For the remaining euro area countries, the outcome is less clear, especially in Italy where TLTRO drawings exceed banks’ deposits at the Bank of Italy. Italian banks have traditionally had access to a deep domestic deposit market, which they can turn to but they may also need to pass higher funding costs to their customers.

For banks in certain markets, TLTROs could remain attractive as yields and spreads rise. Which bears the question: how realistic it is to fully phase out all TLTROs without any alternative options?

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope`s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.