Announcements

Drinks

French banks and the benefits of rising rates: the risk of slow-motion 2023

“Performance was positive in 2022. French banks benefited from supportive lending dynamics, a strong contribution from capital market activities and controlled cost of risk,” said Nicolas Hardy, deputy head of Scope’s financial institutions team, “although return on average equity, ranging from around 4% to below 9%, remains in the lower range compared to European peers.”

The first headwind the banks face this year is that interest revenues are rising more slowly than banks in other European countries because of characteristics specific to France. Retail customers, which represent a significant portion of French bank balance sheets and P&Ls, have legal protections against rising interest rates in the form of a rate cap. The formula to reset maximum acceptable rates (so-called usury rates) is a backward-looking measure based on recently observed rates.

Mortgages are mainly fixed-rate for life. When rates go up, repricing can only happen when a new mortgage is granted. The return on regulated savings such as Livret A (EUR 343bn, 19% of total bank deposits) is inflation-linked and adjusts more quickly than normal (usury) rates. These characteristics can significantly delay the benefits of higher interest rates for banks. Rates in this context move slowly in comparison to inflation.

“Slowly adjusting rates combined with falling new lending volumes would be an issue for banks, although so far, there is no indication that tightened financial conditions are having a massive effect on new loan production,” Hardy said.

In fact, corporate and household loan production remains steady, rising by 7% and 5% respectively in 2022. Mortgage origination has slowed since June 2022 but net flows are resilient. Consumer loan production is also resilient. Mortgage rates are getting back to 2015 levels. This will result in affordability issues but only at the margins.

A second headwind arises from the the challenge of maintaining cost discipline in an inflationary environment. “French banks already have above average cost-to-income ratios, and better cost efficiency was a broad-based strategic focus in the low interest-rate environment. Progress made so far has been modest, however. In 2023, in the context of persistent inflationary pressure and potentially lower revenues, growing operating revenues more rapidly than operating expenses will be a challenge,” Hardy cautioned.

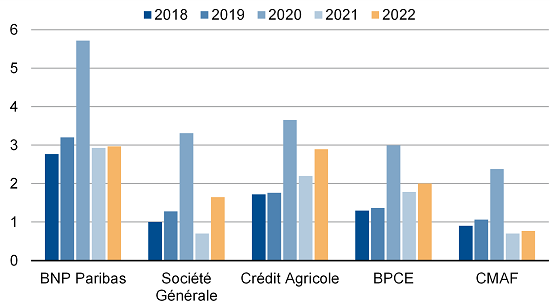

Weakening asset quality is another potential headwind, although this will be contained. And it is less of a major concern to French banks because of their ongoing efforts to improve balance-sheet quality. “Cost of risk was satisfactory in 2022 and guidance for 2023 is conservative, only slightly up and in line with long-term averages or medium-term strategic objectives,” said Hardy.

Still average cost of risk (EUR bn)

Crédit Agricole: Crédit Agricole Group; BPCE: BPCE Group; CMAF: Crédit Mutuel Alliance Fédérale (part of Crédit Mutuel Group).

Source: banks, Scope Ratings

Problem loans (Stage 3) are below the 3% mark for all banks while Stage 2 loans, about 10% of customer loans, fell in 2022 and are in line with the European average. Banks have also kept large buffers of unallocated credit provisions.

Scope has subscription ratings on:

- Banque Fédérative du Crédit Mutuel

- BNP Paribas S.A.

- BPCE S.A.

- Crédit Agricole S.A.

- Société Générale S.A.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions such as for Credit Sphere.