Announcements

Drinks

Italian Bank Quarterly: growing resilience despite uncertainties

“Italian banks’ financial fundamentals are rock-solid,” said Alessandro Boratti, Scope’s lead analyst for Italian banks. “As expected, third-quarter profitability plateaued after peaking in Q2. But Italian lenders are confident they can repeat or even beat 2023 results next year thanks to higher rates, a rebound in fees, cost efficiencies and low credit losses.”

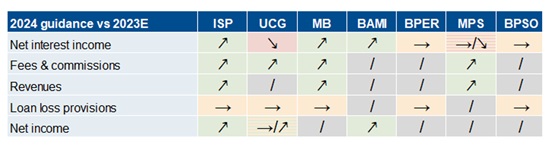

Italian banks’ provisional guidance* on 2024 P&L items vs 2023

Notes: Mediobanca refers to FY 2023/24 ending next June. *BPER and BPSO based on management’s opinion.

Source: Management guidance, Scope Ratings

The banks still have to navigate some turbulent waters, however. Competition for deposits may increase more than expected in 2024 among banks, also due to government bonds targeting retail investors (BTP Valore). The lending outlook is darkening too as demand for credit declines. This could have an impact on the Italian economy, where growth in 2024 will also depend on the complicated geopolitical backdrop.

“Heightened tension in the sovereign bond market and the possibility of a new windfall tax are additional downside risks,” Boratti said, “but asset quality is stable for now. Even though the improvement in headline credit-quality metrics is coming to an end, there are no clear signs of deterioration yet. This is likely down to the resiliency of businesses and households, combined with the time-lag between slowdown in the real economy and defaults.”

Capital positions are strengthening thanks to earnings retention and a reduction in risk-weighted assets. Banks were allowed to convert the windfall tax on ‘extra-profits’ into non-distributable reserves at 2.5x the tax amount so with no impacts on profits and capital.

“Stability in deposits in the past two quarters may indicate that savvier customers have already moved their money out of current accounts. That said, we expect more deposit attrition in 2024, especially if the ECB maintains its rates policy.

Download the Italian banks quarterly here.

Scope has public ratings on the following Italian banks:

Scope has subscription ratings on the following Italian banks. To view the ratings and rating reports on ScopeOne, Scope’s digital marketplace, or to register, please click on the following links:

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.