Announcements

Drinks

French banks 2024 outlook: resilient credit profiles underpinned by recovering retail margins

“Banks anticipate that by the middle of 2024, the benefits of balance-sheet repricing should be more visible,” said Nicolas Hardy, deputy head of financial institutions. “Easing margin pressures in domestic retail will mitigate lower loan production as high interest rates put a brake on economic growth and lending dynamics.”

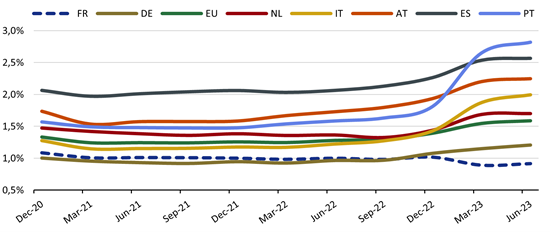

The rise of net interest margin across selected EU countries

Source: EBA risk dashboard, Scope Ratings

Hardy points out that the slower increase in interest rates has been a protective feature for customers, especially in mortgage lending, and adds that pockets of credit risk in vulnerable sectors such as commercial real estate or SMEs will remain challenging. But Scope does not anticipate broad-based asset-quality deterioration.

“While corporate bankruptcies continue to normalise and are now close to long-term averages, credit dynamics were broadly positive for the first nine months of 2023,” Hardy said. “As banks tighten their underwriting criteria, credit growth will likely mirror moderate economic growth in 2024.”

Cost of risk was volatile in 2023. Banks guided to metrics that are in line with their initial targets or their medium-term averages of 20bp-30bp. “We do not see any signs that banks are anticipating materially worse asset quality by increasing precautionary buffers,” Hardy continued.

Property markets are among the most sensitive to rising rates. In France, real estate activities account for the largest corporate sector exposure (23.1%), but the 2% sector NPL ratio is broadly stable compared to end 2022. “Gross sector exposures are material in absolute terms but less so in relative terms given the split by sub-segments, foreign exposures, and the overall granularity of corporate sector exposures,” Hardy explained.

Business diversification was the key differentiating factor for diverging profitability trends in 2023. Well-integrated insurance activities eased pressure on core retail banking thanks to cross-selling and operational synergies. Corporate and investment banking business lines, which can be a source of earnings volatility, experienced another strong year thanks also to geographic and business diversification. There were positive effects too from other international activities, such as higher interest margins in Italy for Crédit Agricole and BNP Paribas.

Download the French banks outlook here.

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.