Announcements

Drinks

European Bank Capital Quarterly: refinements to supervision and regulations are credit supportive

“In addition to updating the methodology used to determine Pillar 2 requirements from 2026, the ECB is implementing other changes that will allow supervisors to focus on risks that require greater attention, moving away from a ‘tick-box’ approach,” said Pauline Lambert, executive director in Scope’s financial institutions team.

“There is a clear recognition by supervisors that the risks facing banks are evolving and that conducting risk assessments has become more complex due to structural changes, new risks, and external shocks, such as geopolitical tensions, inflation, climate change and digitalisation,” Lambert added.

The complexity is compounded by the lack of historical data and established models for managing many of these risks. Supervisors also intend to be increasingly forceful in using the full range of available tools to prompt banks to remedy identified weaknesses.

Just as reforms to the supervisory process aim to improve the resilience of banks as going concerns, proposed revisions to the Crisis Management and Deposit Insurance (CMDI) framework aim to improve the process for dealing with failing banks.

The amendments will facilitate the use of early intervention measures to stem the deterioration in a bank’s position (i.e. removal of management); extend the scope of resolution to some small and medium-sized banks; increase the likelihood of using resolution rather than liquidation procedures; and give all depositors a general preference in insolvency.

“While the third pillar of the banking union, the European Deposit Insurance Scheme, is still missing, harmonising the treatment of depositors across the EU would be a positive step in this direction although the earliest new CMDI rules would apply is 2026,” Lambert said.

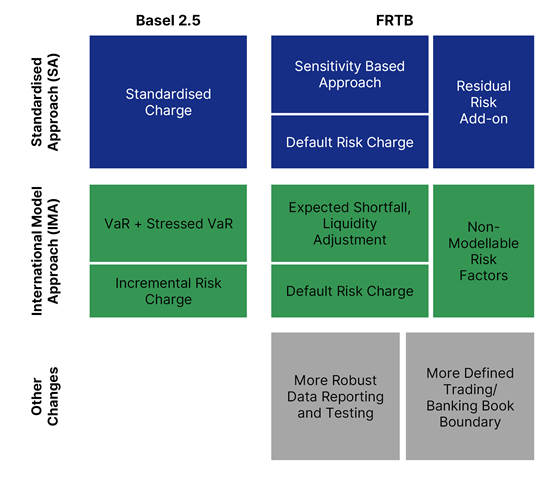

Final Basel 3 standards have now been published in the Official Journal of the EU and will apply from 1 January 2025. The one area where implementation will be delayed is in regard to market risk standards (Fundamental Review of the Trading Book) given the likely delay in other major jurisdictions and the potential impact on the competitiveness of European banks. “The more stringent and risk-sensitive approach is expected to result in higher capital requirements, especially for banks with significant trading activities,” Lambert said.

Changes to market risk capital framework under the FRTB

Source: SIFMA, Scope Ratings

Download the European Bank Capital Quarterly here.

Stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.