Announcements

Drinks

Supervisory changes to assess bank risk and calculate capital add-ons a positive step

By Pauline Lambert, Executive Director, Financial Institutions

Supervisors recognise that the risks facing banks are evolving and that conducting risk assessments has become more complex due to structural changes and emerging new risks in areas like climate change and digitalisation. This is compounded by the lack of historical data and established models for managing many of these risks.

A multi-year assessment approach, a flexible risk-assessment system and shorter decision-making will be introduced in the 2025 Supervisory Reivew and Evaluation Process (SREP) cycle, while a revised methodology for determining Pillar 2 Requirements (P2R) will be used from the 2026 cycle.

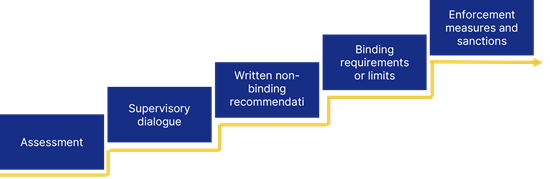

Amendments to the SREP are also intended to make supervision more effective by ensuring that the full range of tools is used. If banks fail to remedy identified weaknesses, the ECB intends to use increasingly stringent supervisory tools. This includes greater use of legally binding qualitative requirements and enforcement measures such as periodic penalties.

ECB supervisory escalation framework (illustrative)

Source: ECB, Scope Ratings

The ECB believes revisions to the P2R methodology will make the process more stable and simpler. We expect the revised methodology to be more transparent about how P2Rs are determined, and which risks the capital add-ons are meant to address.

With the implementation of the latest iteration of the Capital Requirements Regulation (CRR3), the revised methodology should also allow supervisors to consider whether the output floor capture risks that are currently covered by P2Rs. CRR3 entered into force on 9 July 2024 in the EU and will apply from the start of 2025.

Following positive trials in 2023, the ECB plans to move to multi-year assessments. Under this approach, certain areas for review will be prioritised each year while remaining topics will be assessed at a later stage. The aim is to give supervisors the flexibility and capacity to focus on the risks that require the most scrutiny and potential intervention, and to become less ‘tick-box’ in their approach.

This complements the flexible risk-assessment system, which allows supervisors to complete the assessment of less time-sensitive topics (those not linked to the publication of annual financial reports) throughout the year. This includes assessments of business models, internal governance and other qualitative topics. In cases where there is no material change to a bank’s risk profile, supervisors will also have more latitude to update SREP decisions every two years under some conditions rather than annually.

While there is a notional possibility that a risk may be overlooked if it is not considered a supervisory priority in a given year, it is also the case that some elements of the SREP can be extremely slow moving. Reassessing them at high frequency does not necessarily add a lot of value.

A bank’s business model is a good example. We undertake regular annual reassessments and most of the time they do not change our view of a given bank, which underpins rating stability through the cycle. Changes to business-model assessments typically result from deeper strategic revamps or M&A activity. As long as the flexible approach provides supervisors with the capacity to increase their focus on risks, this is indeed a welcome development.

Stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.