Announcements

Drinks

Deutsche Bank: Improved profitability outlook on non-operating cost normalisation

By Julian Zimmerman, Financial Institutions

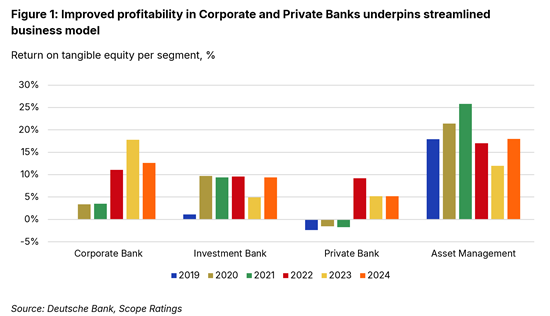

Continued, focused implementation of the bank’s strategy would be credit positive, as highlighted in our revision of the Outlook on the bank’s A- rating from Stable to Positive on 13 December 2024. Evidence that Deutsche Bank continues to deliver structural and durable improvements in the efficiency and profitability of its Corporate and Private Bank segments, among other factors, could lead to a more favourable assessment of the business model, with positive rating implications (Figure 1). Average allocated tangible equity was around 19% of the 2024 total in the Corporate Bank and 24% in the Private Bank.

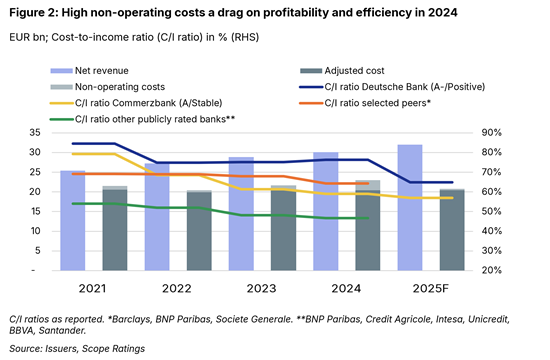

Return on tangible equity (RoTE) and cost-to-income targets for 2025 are ambitious but achievable if non-operating costs stay in line with projected levels of EUR 400m. The bank is aiming for a RoTE of over 10% this year, up from 7.1% in 2024, and a cost-to-income ratio of below 65%, down from 71%, both on an adjusted basis. The bank is due to refresh its strategy and targets beyond 2025 later this year.

The bank will need to contain any cost slippage, however, to allow its still-elevated cost-to-income ratio (Figure 2) to further converge with peers. While the upwards revision of the bank’s target efficiency ratio for 2025 highlights ongoing cost inflation and a need to invest in key business areas, the revision is relatively moderate.

Robust revenue outlook, with some uncertainty on revenue gap to 2025 target

We view positively that most of the bank’s projected 6% year-on-year increase in revenues in 2025 (to around EUR 32bn) is expected from relatively predictable sources and that the bank has hedged its net interest income against interest-rate cuts. Market share gains in Advisory and Origination and growing assets under management should support fee income in coming quarters.

Some reliance on less predictable revenues remains, however, such as those from certain segments of the Investment Bank. The Investment Bank accounted for 35.1% of net revenues in 2024.

Robust asset quality, moderate cost of risk; downside risk from Germany, US CRE

We expect cost of risk (CoR) to remain broadly stable in 2025. CoR was 38bp in 2024, up from 31bp in the previous year and in line with expectations. Given the weak economic outlook for Germany, with expected growth at 0.1% in 2025, downside risks to credit quality persist. However, Deutsche Bank’s loan book is well diversified and largely secured.

One area of focus is the bank’s sizeable commercial real estate (CRE) portfolio, in particular in the US. Performance could be negatively affected if US government policy results in higher-for-longer interest rates. At the same time, higher growth spurred, for example, by deregulation and tax cuts, could positively impact borrower quality in this segment. We take some comfort from the specific stress testing the bank performed on a higher-risk non-recourse CRE sub-segment, representing 6% of total loans (53% of which in the US), and consider risks arising from this portfolio to be manageable.